Bitcoin has become increasingly popular in recent times with the digital asset exploding into the consciousness of the mainstream thanks to a few key events. The digital coin is going on 12 years old, but it is in the last four or so years that it has really become a major phenomenon for every person.

However, Bitcoin is still a rather complicated subject, and while it is not too hard to grasp its basics and what it does, to really understand how it works and what goes into the mechanisms of this digital currency requires a bit of research. From its main concepts — like cryptography and decentralization, to blockchain and digital transactions, not to mention mining and halving, there are a few concepts worth understanding to get a full grasp of the coin.

What is Bitcoin (BTC)? The Most Popular Cryptocurrency

Bitcoin, as described by its mysterious creator, Satoshi Nakamoto, is defined as a peer-to-peer digital cash system. That is to say it is intended to be like cash, but to exist entirely digitally, and even more so, to exist with no person or company behind it. However, even since it was outlined like this, Bitcoin has grown and evolved to be more than just a digital currency.

At its core, Bitcoin is a digital asset that can transfer value from one individual to another, digitally, without the need for intermediaries, like a bank. Bitcoin thus has the properties to store value — and this is seen in its fluctuation market, but it also has the ability to be transferred. These two properties pout it somewhere between being like cash, and being like gold.

It was the first cryptocurrency ever created, and is created on a technology known as blockchain, but since it came to be in 2009, it has spawned an entire ecosystem with hundreds of other coins also based on blockchain. Yet, Bitcoin still remains the biggest, and most popular.

Main Concepts of Bitcoin

To understand why Bitcoin has become so popular, and why it has grown to be what it is today, one needs to understand the concepts behind this digital currency system. Through the use of blockchain technology, and digital means, Bitcoin has become an incredibly efficient and clever tool for a number of aspects. It is secure, uncontrolled, trustless and self contained — this is very different from our current financial systems which have their flaws that Bitcoin was especially created to combat.

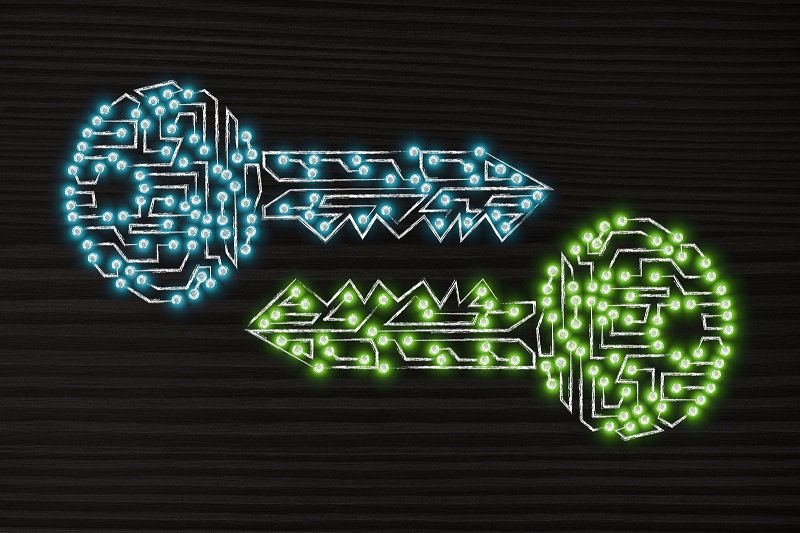

Cryptography

In terms of the key concepts of Bitcoin, we can get a hint from the word cryptocurrency — cryptography is an important aspect that ensures security in Bitcoin. Cryptography is the protection and anonymity that is ensured in Bitcoin. It is used across a number of different places in the operation of Bitcoin.

For example, it is used in securing transactions, it keeps users anonymous as they are only known by their address keys, and it helps verify transactions and tokens. If we use a real world example to explain this it is similar to a signature, like on a cheque.

A signature needs to be verifiable and uniquely linked to you; it needs to secure enough that it cannot be counterfeited or copied and it is a mark that you are aware of the transaction that you cannot renegade from later — this is all the same in cryptography and in Bitcoin’s own make up.

Bitcoin emulates signatures through cryptography techniques and encryption keys, this is the use of mathematical codes to store and transmit data for only those that are tied to the key — or signature. By having these cryptographic codes, a transaction, and a user can be identified and verified, but still kept secure and even anonymous.

Decentralized Networks

One of the most exciting aspects of Bitcoin is its decentralised nature. When Bitcoin was created, it was intended to be a financial system that was operated by people rather than a centralized force at the top. And, as time has gone on and the likes of banks and other companies have let people down, so the idea of decentralisation has become more prized.

Decentralisation in the case of Bitcoin means that the ownership and direction of the cryptocurrency is spread across millions of individuals. People who want to mine the token, and also secure it at the same time through an algorithm called proof-of-work, can easily do so. Even node operators, people who ensure the continued running of the network, can be anyone.

This decentralising of the network means that it is almost impossible to hack or change as Bitcoin is an ongoing leder of transactions that every node has access to and can verify. For example, if you hacked into a bank, you could hypothetically change the balance of your account and get away with it. But if you hacked into one node on Bitcoin and changed your transaction, it would be rejected thanks to the decentralised network not agreeing with that change.

Supply and Demand

Because Bitcoin operates like a cash system, as well as a store of value, it has important economic principles attached to it as well — such as supply and demand. Bitcoin has been called digital gold on occasions, and this is a good analogy to understand the supply and demand pressures on the market.

At the core of this concept is the fact that Bitcoin is a finite entity. There will only ever be 21 million coins in existence. At the moment, not all of those coins are circulating, rather there are still mining efforts being made to mint new coins. However, even this process is designed to slow down meaning there will be less and less coins entering the market as time goes by with the last coin set to be minted in 120 years time.

This finite supply, and decreasing circulating supply means that Bitcoin is subject to a higher demand naturally. Having less supply inevitably leads to a higher demand, and a higher demand for anything will move it to become more valuable — this is true for Bitcoin and also makes it an anti inflationary asset.

Double-Spending

One of the bigger concerns when examining Bitcoin on a hypothetical level is the threat of what is known as double spending. Double spending is the risk of a digital currency. Like Bitcoin, can be spent twice.

The reason this risk exists is because of the digital nature of these currencies and the fact that copying digital products is not too difficult, especially for those who know how to do it on a blockchain level. Double spending can be a problem for certain blockchains and cryptocurrencies, but it can also be mitigated as a risk.

Double-spending is usually initiated as a way to steal funds by trying to disrupt a blockchain network. The thief would send a copy of the currency transaction to make it look legitimate, or might erase the transaction altogether. The most common method of double-spending is when a blockchain thief will send multiple packets to the network, reversing the transactions so that it looks like they never happened.

Because there is no central authority to confirm transactions, Bitcoin has developed a mechanism to combat this potential disruption.

Bitcoin’s mechanism means that all transactions be included in the blockchain, or ledger. And, because the ledger is decentralized, it is difficult to confuse and rewrite the ledger; it prevents double-counting and other fraud. The blockchain of verified transactions is built up over time as more and more transactions are added to it.

Bitcoin Blockchain

We have mentioned that Bitcoin operates on a new technology known as blockchain, and the Bitcoin blockchain is the first occurrence of this technology ,and thus it is also the most well established. But, it is important to understand how this underlying technology plays a role in the cryptocurrency ecosystem.

Essentially, Blockchain is a type of database, but unlike a normal database it store data in blocks that are then chained together so when new data comes in, the chain is grown and an ongoing ledger is what remains — usually with transaction data

In Bitcoin’s case, blockchain is used in a decentralized way so that no single person or group has control—rather, all users collectively retain control. The technology is also immutable — or unchangeable once written, and thus also irreversible so this adds to the security along with the decentralization.

Other than the security of the transactions, blockchain also encrypts the information by making use of two types of cryptographic algorithms, asymmetric-key algorithms, and hash functions.

Essentially, each block can be seen as a new page in an ongoing ledger or balance sheet. Everytime someone makes a Bitcoin transaction this is written down in the ledger, but this ledger is updated across the world to a decentralized network. This means if one person tries to change the ledger to cheat it and make money they don’t have, it will be rejected by the rest of the network.

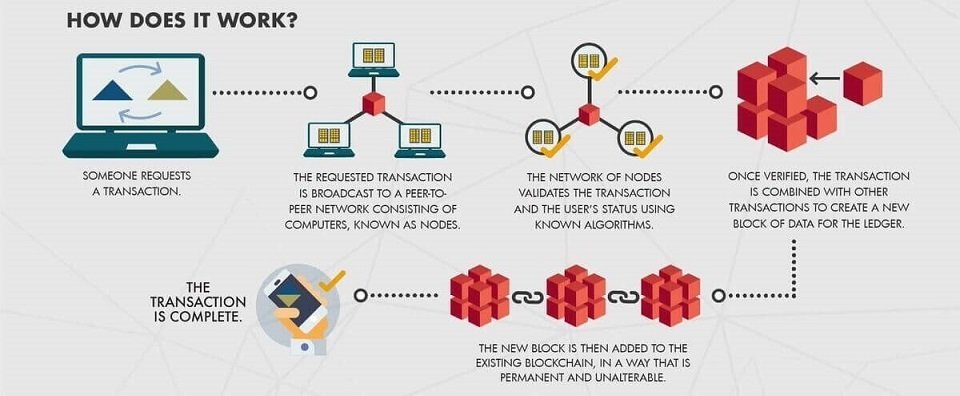

Bitcoin Transactions

Bitcoin transactions are the lifeblood of the Bitcoin network, and its entire blockchain. It is important to understand this as here is where a transfer of value is made and how Bitcoin operates like cash.

A transaction is a transfer of value between Bitcoin wallets that gets included in the blockchain. These wallets hold a piece of data called a private key or seed, which is used to sign transactions, providing a mathematical proof that they have come from the owner of the wallet.

This wallet signature also means that the transaction won’t be changed or fraudulently altered and then the transaction is sent to the entire network to be confirmed on the ledger. In order to confirm this transaction, there is a fee that needs to be paid in order to incentivise people on the network to ensure its security.

For example, suppose Alice wants to send some Bitcoin to Bob , there will be three parts to it.

Firstly, an input which is a record of the BTC address from which Alice initially received the bitcoin he wants to send to Bob , then an amount will need to be specified by Alice , and finally an output — this is Bob’s public key; also known as her ‘bitcoin address’

Getting the Right Inputs

To get these transactions right, the three sides of it need to be correct and operate securely. Looking at the example above, Alice’s wallet will first have to find inputs that can pay for the amount she wants to send to Bob. Most wallets keep a small database of “unspent transaction outputs” so this means it will contain a copy of the transaction output from Bob’s transaction, which was created in exchange for cash. The wallet is thus carrying what is known as a lightweight index of the blockchain ledger in order to make sure it has the right inputs.

Creating the Outputs

Once the right input is found, and the wallet has ensured there is a corresponding amount of Bitcoin that can be sent, it is about matching it with the wallet output. In other words, Alice’s transaction output will contain a script that says something like, “This output is payable to whoever can present a signature from the key corresponding to Bob’s public address.”

Because only Bob has the wallet with the keys corresponding to that address, only Bob’s wallet can present such a signature to redeem this output. Alice will therefore “encumber” the output value with a demand for a signature from Bob.

Adding the Transaction to the Ledger

Once these two sides, the input and the output, have been met then it is about ensuring the transaction is added to the Bitcoin network. This is done by transmitting the transaction across the entire decentralized network and it will come from Alice’s wallet sending the new transaction to any of the other Bitcoin clients it is connected to over any Internet connection:

Transmitting the transaction

This transaction has all the information about the transactions and the process between the two wallets but it does not matter how or where it is transmitted to the Bitcoin network because the network is a peer-to-peer network, with each bitcoin client participating by connecting to several other bitcoin clients.

Spending the Transaction

Once the transaction is broadcast and written into a block on the blockchain the transaction is seen as valid.

Bob can now spend the output from this and other transactions, by creating his own transactions that reference these outputs as their inputs and assign them new ownership. For example, Bob can pay a contractor or supplier by transferring value from Alice’s payment to these new owners.

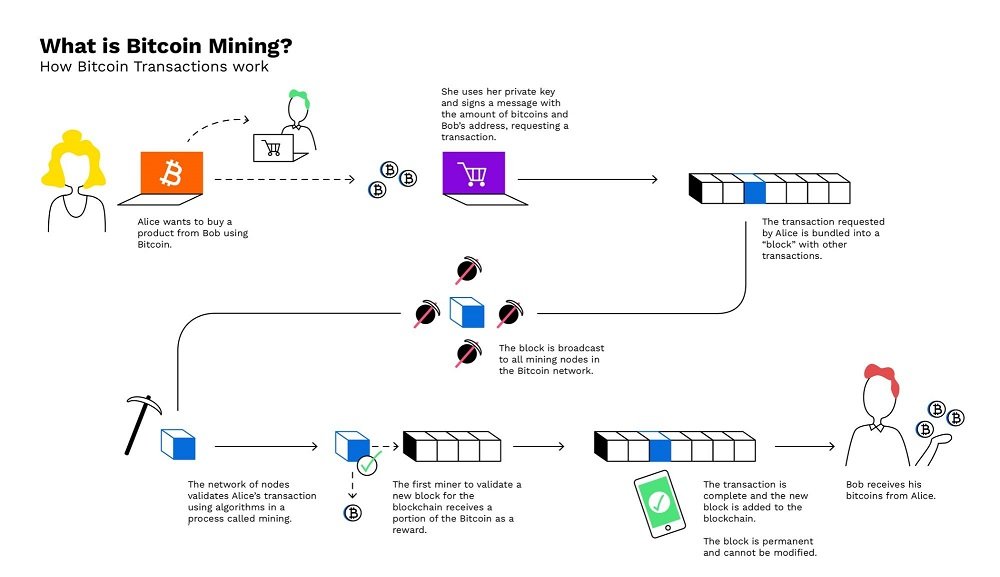

Bitcoin Mining

Another vital part of the Bitcoin network has to do with the mining of new coins. Not only is this how new circulating Bitcoin is added to the supply, but it is a way in which the network is secured and transactions are validated.

On the face of it Bitcoin mining is performed by high-powered computers that solve complex computational math problems. When these are solved, the computer is rewarded by unlocking a new block for the blockchain and is also given a set reward in BTC.

In terms of securing and validating the network, When Bitcoin miners add a new block of transactions to the blockchain, part of their job is to make sure that those transactions are accurate. In particular, bitcoin miners make sure that Bitcoin is not being duplicated like in

Double-spending.

Hashes in Mining

When we talk about the complex equation that a Bitcoin miner needs to solve, we are talking about the cryptographic hash. In simple terms, hashing means taking an input string of any length and giving out an output of a fixed length. In the context of cryptocurrencies like bitcoin, the transactions are taken as input and run through a hashing algorithm which gives an output of a fixed length. If the right hash is met, then the block is unlocked and a reward given.

Bitcoin uses what is known as SHA-256, it is used in several different parts of the Bitcoin network from mining , which uses SHA-256 as the Proof of work algorithm and a way to secure transactions. SHA-256 is used in the creation of bitcoin addresses to improve security and privacy.

Mining Transactions in Blocks

Transactions are added to new blocks that are mined in order of the highest-fee transactions first and a few other criteria. Each miner starts the process of mining a new block of transactions as soon as he receives the previous block from the network, knowing he has lost that previous round of competition.

How does Mining Difficulty Secure Bitcoin?

As described above, mining is a difficult process that is made so for computers in order to ensure fair distribution of coins, but also to secure the network. If the problems were too easy to solve, the circulating supply would be flooded, and a sector of the mining community could gain enough power over the network to break the decentralization of it and enforce what is known as a 51% attack.

Without having this difficulty in mining, people could spoof transactions to enrich themselves or bankrupt other people. Being able to get on top of the Bitcoin mining difficulty means that people could log a fraudulent transaction in the blockchain and pile so many trivial transactions on top of it that untangling the fraud would become impossible.

In order to get to this point of fraudulent control over a chain like Bitcoin’s there needs to be what is known as a 51% attack where over 50% of the hashing power is in control of one person or group. Having this mining control would mean that the miners could pick and choose which transactions they verify and lead to a point where they could double spend.

The fact that Bitcoin mining is a tough and time consuming process in terms of solving the equations means there is the need for huge power resources and mining capability to take over 50 percent of its hash rate — something that has never happened, and one of the reasons that bitcoin is so secure.

Keys and Wallets

Looking more towards Bitcoin users, they will be interacting with the cryptocurrency mostly through their wallets, which in turn are controlled by their keys. This is what makes up the ownership of the digital currency.

Within a user’s wallet, there are two keys — the private key, and the public key. The public key is a little like your bank account details; it is identifiable to you, and also shareable for those wanting to send value to you.

Your private key on the other hand is like your bank card pin code. It is something that should not be shared, and it is your key into your account to access your funds. These keys are what make a wallet work, but there are also different types of wallets to consider.

Bitcoin can be stored in a hot wallet, or a cold wallet. The hot wallet is one that is constantly online and keeps cryptocurrency stored on the cloud via an exchange or other third-party service. However, a cold wallet can take your crypto offline as the private key is then stored on something like a flash drive which is untouchable online when it is not connected.

Halving

One interesting part of Bitcoin’s technical make up is the halving. This event, which takes place every four or so years in the case of Bitcoin, is a mechanism that is intended to make the cryptocurrency anti-inflationary.

The halving refers to the mining rewards that are given each time a block is solved for getting cut in half. So, at the first Bitcoin halving, the rewards went from 50 BTC for solving an equation to 25 BTC. One can see straight away the effect this would have on new coins entering the market.

But more than that, it is intended to reduce supply which in turn increases demand and thus make the price of the coin increase in value, rather than inflate and lose value. To put it another way, 50 BTC rewarded just before the first halving is worth less today than 6.25 BTC, the current reward for mining.

How Can You Buy Bitcoin?

Of course, Bitcoin has come a long way from its early days and has become a lot more mainstream meaning it is also a lot more accessible. People can now buy Bitcoin in a couple clicks on their smartphones, or even withdraw some from ATMs, in a similar way to cash.

Broker Exchanges

One of the most popular ways to buy Bitcoin today is through broker exchanges. The reason being is that these exchanges not only give you access to Bitcoin to hold and store, but also have associated trading tools and opportunities to maximize your potential profits with the cryptocurrency.

Many good broker exchanges have emerged in the Bitcoin space that have taken the user experience of other traditional financial apps and combined it with powerful cryptocurrency trading to offer a unique and effective service. A well known example of this is Caltex Pro Minerss, a broker exchange that lets you start buying and trading Bitcoin in a matter of minutes. Sign up for it here.

P2P (Peer-to-Peer) Exchanges

P2P exchanges are another option for buying Bitcoin and operate like a traditional market for any good or asset. It means that there is a market where people are wanting to sell their Bitcoin to people wanting to buy. A price is agreed upon and the trade is made.

This means there is no direct middleman, and thus no added fees like in exchange brokers. But it also means there are less protections and als a far harder to use user experience.

Bitcoin ATMs

Bitcoin ATMs are growing in popularity as they continue to be rolled out across the globe as the coin is further normalized. These allow you to buy Bitcoin on the go and to exchange cash directly for the digital asset.

These ATMs are still quite novel as ideas — as Bitcoin buying can be done from a smartphone, and they also usually have higher fees than exchange brokers.

Pros & Cons of Bitcoin

Like everything, there are pros and cons when it comes to Bitcoin. The digital asset is certainly one for the future, but that means there is still some work to be done on it to make sure it fits into the current world order.

| Pros | Cons |

|---|---|

| Faster International Payments | Electricity Costs for Mining |

| Low Fees | Not the fastest Crypto |

| Blockchain Security | Volatile Fees |

| Decentralized | Potential for Illicit Uses |

| Transparent | Still Difficult to Use |

| Anonymous | |

| Community Powered | |

| Open to New Users |

Bitcoin Pros

- Faster International Payments:- Bitcoin has shown itself to be truly global and even borderless. For users this means that international payments can be quicker and not subject to different banking laws.

- Low Fees:- Bitcoin is also usually a lot cheaper when it comes to transacting as compared to major banks and traditional financial services

- Blockchain Security:- Blockchain as a technology has shown to be incredibly secure and has yet to be truly hacked at a base leve.

- Decentralized:- Decentralisation is showing its value in the current world order as people appreciate the power of a decentralised group when it comes to financial services

- Transparent:- Bitcoin’s transparent and available ledger means that it is open and available for all to see which has added benefits for accountability etc

- Anonymous:- At the same time, Bitcoin is also anonymous, and in a world where privacy and data sharing is key, this adds another layer of protection

- Community Powered:- As with decentralisation, the idea of having the ecosystem adhere to the will of the community through democratic processes means that no one company or person is in control.

- Open to New Users:- Bitcoin is also very inclusionary meaning that anyone with access to the internet is welcome to use it — this is not the same for banking with unbanked communities reaching into the billions.

Bitcoin Cons

- Electricity Costs for Mining:- Bitcoin mining uses relatively a lot of energy as it is part of the way to make the process difficult to ensure security. For this reason people are concerned about its ability to be green

- Not the fastest Crypto:- Bitcoin is certainly the biggest and most popular cryptocurrency, but since it was created other coins have been created to work faster and more efficiently than it.

- Volatile Fees:- Just like its price, Bitcoin is also subject to changing fees, usually based on its popularity and user base. The more people using it, the more expensive it is to use.

- Potential for Illicit Uses:- Bitcoin has also been labeled as a tool for crime as it offers a form of anonymity, however, this narrative is falling away as people realise that it is not Bitcoin that is the problem in that regard.

- Still Difficult to Use:- A lot like email in the early days of the internet, Bitcoin is still quite difficult to use as the user experience aspect of the coin still takes time to be worked out ahead of other technologies.

- Summary

In summary, Bitcoin is a technology almost ahead of its time when it was created in 2009, however, the world has started catching up and its place in the world is being figured out and carved in. Bitcoin has a lot to offer the continually digitizing world and will surely impact many parts of our lives.

From the financial applications to the security and possibility of blockchain, Bitcoin is being welcomed into the world and embraced by people more and more as it is normalized and legitimized for its huge possibility.

Is Bitcoin Infinite?

There are 21 million coins that will ever exist meaning Bitcoin is not infinite. The final coin will only be minted in over 100 years time because of the control of supply

Is It Safe?

Bitcoin is safe. The blockchain itself is one of the most safe technologies around. However, like anything financial, and nascent, there are risks that should be carefully considered.

How Do I Invest?

There are a number of ways to firstly buy Bitcoin, which is a form of investing, and there are also a number of platforms to use which will allow you to invest in Bitcoin in a number of ways. Using exchange brokers is the most powerful way to invest.

How Does Bitcoin Make Money?

Bitcoin is not an organisation looking to make a profit, it is a decentralised ecosystem which operates for the people. Those who work in that ecosystem as miners or nodes are rewarded for their operations via the Bitcoin blockchain

Can Bitcoin Be Converted To Cash?

Yes. Bitcoin can be sold online in a number of ways, once sold, Bitcoin can be equated for a fiat value and depending on the platform you use, that fiat value can be withdrawn.

Are Bitcoins A Good Investment?

Bitcoin has shown in recent times to be a great investment as it is one of the best performing assets in the world from the last decade. More so, the likes of Tesla and other big corporations have started buying Bitocin as an investment.

What Will Bitcoin Be Worth In 2030?

It is difficult to say what Bitcoin;s value will be in so far advance, but based on the last 10 years, Bitcoin went from brewing worth a few cents to upwards of $50,000.

Risk Disclaimer:

Investing in or trading gold or other metals can be risky and lead to a complete loss of capital. This guide should not be considered investment advice, and investing in gold CFDs is done at your own risk.

The information provided does not constitute, in any way, a solicitation or inducement to buy or sell cryptocurrencies, derivatives, foreign exchange products, CFDs, securities, and similar products. Comments and analysis reflect the views of different external and internal analysts at any given time and are subject to change at any time. Moreover, they can not constitute a commitment or guarantee on the part of Caltex Pro Minerss. The recipient acknowledges and agrees that by their very nature any investment in a financial instrument is of a random nature and therefore any such investment constitutes a risky investment for which the recipient is solely responsible. It is specified that the past performance of a financial product does not prejudge in any way their future performance. The foreign exchange market and derivatives such as CFDs (Contracts for Difference), Non-Deliverable Bitcoin Settled Products and Short-Term Bitcoin Settled Contracts involve a high degree of risk. They require a good level of financial knowledge and experience. Caltex Pro Minerss recommends the consultation of a financial professional who would have a perfect knowledge of the financial and patrimonial situation of the recipient of this message and would be able to verify that the financial products mentioned are adapted to the said situation and the financial objectives pursued.