Bitcoin is an asset unlike anything else before it and is built on a futuristic distributed ledger technology called blockchain. The blockchain records all of the transactions across the Bitcoin network, making them transparent to all and completely unalterable. This unique, decentralized network and cryptographic mechanism is what gives Bitcoin value.

This value over time has grown exponentially, making Bitcoin one of the greatest investments to ever exist. Bitcoin has grown in price from relatively worthless and less than pennies per coin, to well over $40,000 each.

While it might seem too late to purchase the cryptocurrency, even billionaire hedge fund managers such as Paul Tudor Jones still compare Bitcoin now to investing early in companies like Apple or Google. Others say it is akin to investing in a piece of the internet during the early dot com days, if the internet was an asset like Bitcoin is. Because this is an opportunity that should not be missed, we’ve developed a detailed guide to assist you in making your first Bitcoin purchase, along with answering any questions might have about “how to buy Bitcoin” along the way.

Why Buy Bitcoin?

Bitcoin is an early technology with near limitless potential. Bitcoin is one part cryptographically secure asset that exists in cyberspace, and one part blockchain network. The two important aspects of Bitcoin work hand in hand to achieve security and consitenscy in data globally.

Investors in Bitcoin typically buy Bitcoin for a few reasons:

- To make money

- To participate in the future of money

- To preserve wealth

- To protect against inflation

- To disrupt current monetary systems

Early Bitcoin investors saw the cryptocurrency as a potential replacement for the dollar. If Bitcoin can replace the dollar as the global reserve currency, its potential as an investment has barely begun.

Early Bitcoin supporters also invested in the cryptocurrency as a way to disrupt current government regimes, central bank-led monetary policy, and more.

More recent Bitcoin investors bought into the “digital gold” narrative driven by fears of hyperinflation. After the pandemic struck, governments printed fiat in response to stimulate the economy. The supply of trillions of dollars has caused investors to flock to Bitcoin, which has a hard-capped supply of 21 million BTC.

Buying Bitcoin offers mathematically sound outcomes. For example, based on the amount of millionaires in the world alone, there’s not enough for each to own one BTC. Based on the global population, there’s only enough for 0.0289 BTC to go around to each individual person.

Institutional investors began to realize that Bitcoin’s scarcity has legitimate value, and it has caused widespread FOMO among high wealth investors. This investor class entering Bitcoin has been responsible for driving prices from $4,000 to $40,000 in less than one year.

Normal investors are now competing with the wealthy to buy Bitcoin, which makes buying it sooner than later that much more important.

Choosing The Best Bitcoin Exchange

Now that you understand why its a good idea to gain some exposure to BTC, it is time to begin searching for a cryptocurrency exchange that offers Bitcoin to buy and more.

Years ago, there were only few platforms to choose from, making finding the right one for each investor that much more challenging. Today, platforms are a dime a dozen, presenting its own unique set of challenges. Sifting through the noise is difficult, so here are some key factors to consider when choosing a Bitcoin exchange.

- Look for a reputable platform, that has industry awards certifying its features

- Seek a platform that allows the ability to buy Bitcoin along with other features like trading

- Consider any platforms that have additional means to increase profitability, such as leverage

- Research the platform’s track record to ensure there are no past instances of hacks or intrusions

For example, Caltex Pro Minerss is an multiple award-winning trading platform that lets users buy Bitcoin easily right from the dashboard using a third party payment widget. Once users have Bitcoin, they can then invest it, trade it, and much more to get the most out of their assets. Caltex Pro Minerss has more than 99% uptime and has never experienced a hack of any magnitude.

Understanding The Different Payment Methods

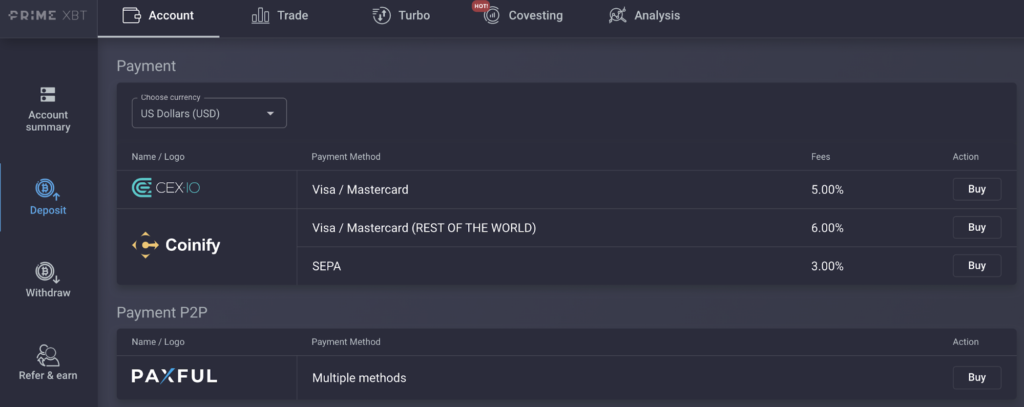

To get started buying Bitcoin, after selecting which exchange platform you would like to use, the next point on the agenda is to understand which payment methods are available and which are best suited to your personal needs.

Buying Bitcoin typically involves a debit card or credit card. However, many platforms also allow for users to directly connect a local bank account for larger purchases, bank wires, and more. Bitcoin exchanges offer secure gateways to buy Bitcoin.

Simply input the amount of Bitcoin you would like to buy or the corresponding amount of fiat currency like USD you would like to spend, and allow the widget to calculate the exchange rate and any associated fees.

Carefully review all details of the transaction to ensure that the exchange rate is fair. Remember, exchanges operate on fees, so don’t be surprised to see a cost tacked on for each Bitcoin purchase. The fee is a worthwhile cost to access what could ultimately be the future of money.

In some cases, platforms will allow you to buy BTC with other cryptocurrencies, like altcoins. Caltex Pro Minerss allows users to trade BTC pairs of altcoins, like EOS, Ethereum, Litecoin, and more.

Where Do I Keep My BTC?

Now that you are ready to purchase Bitcoin, it is time to consider what happens after you receive BTC and are tasked with where to store it.

One of the many benefits of Bitcoin, is that it allows users to “be their own bank” and manage their assets without the need for a third-party intermediary. However, this does come with high risk of loss and certain information you absolutely need to know.

What Is A Bitcoin Wallet?

A Bitcoin wallet is an interface to interact with the Bitcoin blockchain and use it to send, receive, and store BTC. Each BTC wallet consists of a public key acting as the user’s address and a private key that is essentially the password protecting the account. Keeping the private key safe and scure is of the utmost importance. Private keys are typically a 12-word seed phrase.

Bitcoin wallets come as “hot” wallets that are connected to the web, such as apps. When purchased BTC online, the exchange you purchase it at will create a wallet for you immediately upon purchase. This type of a wallet is a “hot” wallet is and is more exposed to things like hackers. Web or app-based wallets are also “hot” wallets, but they are user-controlled.

Wallets also come as “cold storage” wallets which are typically USB or bluetooth connected devices that keep the private key locked behind a secure element. The address and keys are stored in the device, which isn’t regularly connected to the internet, keeping the assets offline and away from the reach of hackers.

How Do I Get A Bitcoin Wallet?

Each time you make a purchase of BTC on an exchange, the company will create a wallet for you that you can use to store, send, or receive more BTC to and from. This is the easiest way to get a wallet.

From there, you can send the BTC to another wallet you create or own. Dozens are apps are available in the app store, and there are several trusted desktop BTC wallets to choose from. Be sure to research which wallets are currently the best. Desktop wallets should always be updated to the latest software version to ensure the highest level of security.

You can obtain a cold storage wallet by purchasing one from many retailers online. Be sure to purchase them from an official source, and be certain that the device doesn’t come with a seed phrase created for you.

How Does Bitcoin Wallet Work?

Bitcoin wallets act as a user interface to interact with the Bitcoin blockchain. The wallet broadcasts any BTC intended to send to the network, and miners must confirm the transaction for it to become valid. Each block takes roughly ten minutes to confirm, but miners can put priority on blocks with the highest fees, so it doesn’t always translate into a fast transaction.

On the other end of the transaction, once miners confirm the transaction, the BTC will arrive in the receivers wallet.

Bitcoin wallets are protected by cryptography, meaning that the computer code is designed to be nearly impossible to hack.

Is A Bitcoin Wallet Safe?

Bitcoin wallets are safe, when all factors are considered.

Online web wallets do pose some risk of exposure to hackers or seizure of funds by the platform that is holding the assets.

Cold storage wallets are the safest solution, however, be sure to consider protecting personal identification info when purchasing a cold storage wallet, and having it shipped to a PO Box or another address separate from where you reside.

You Bought Some Bitcoin. Now What Can You Do With It?

Congratulations, you bought some Bitcoin! You are now one of the early adopters of the cryptocurrency and are partipiating in what could ultimately become the future of money.

But what can you do with it? Here are the most common ways people use their Bitcoin.

HODL: “Hold On [For] Dear Life”

Investments are assets you hold in hopes of price appreciation. Bitcoin investors, however, coined the term “hodl” to explain the uniqueness of what its like to ride the rollercoaster that is Bitcoin investing.

HODL makes sense for those that have no idea what to do with their investments, as it doesn’t take much effort or thought. But many learned the hard way that “HODL” can be a negative term also.

In 2017, when the term was being used the most according to social media data, Bitcoin suffered a major crash from $20,000 to $3,000. Anyone stuck holding on for dear life, was also holding onto serious losses.

Pros

- Easy and effortless approach

- Never miss explosive uptrends

Cons

- Get stuck losing during downtrends

- Miss out on added opportunities by trading

Trade Bitcoin And Other Bitcoin-Based Contracts

Bitcoin is among the more volatile financial assets trading today, which initially made the asset notorious but has eventually become a benefit.

Bitcoin offers traders unrivaled liquidity as a trading asset, and the wild price swings intraday and on higher timeframes make it a highly profitable asset to trade. Those who are successful end up with more Bitcoin, more cash, and more profits overall.

Pros

- Signficanlty more profitable than holding alone

- Increase both BTC reserves and cash position simultaneously

- More engaging approach to investing

Cons

- Takes some time and skill to manage positions

Pay For Goods Or Services

Bitcoin was designed to be a currency and the word currency is included in “cryptocurrency.” Therefore, it was designed to be spent or used to exchange for goods and services, just like cash does.

Because Bitcoin price appreciates so much and so rapidly, investors choose to either hold or trade their BTC, and it is rarely considered for this use case. Still, Bitcoin is accepted as a payment at many merchants globally.

Pros

- It is using Bitcoin for what what it was originally intended

Cons

- Investors miss out on long-term profits

- Possible to live with regret

- Expose personal details through payment processors and gateways

Why Trade Crypto With Caltex Pro Minerss

With Caltex Pro Minerss, you get all of the important factors highlighted within this guide in terms of safety, security, trust, flexibility, and opportunity.

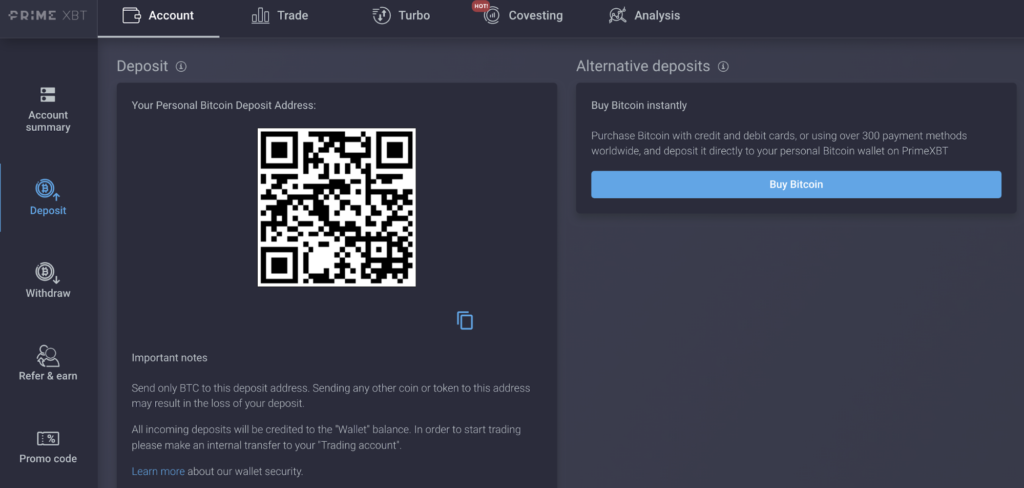

Registration for Caltex Pro Minerss takes only a few short minutes and a matter of clicks to get started. Caltex Pro Minerss lets users buy BTC with a credit card or debit card right from the account dashboard.

Once BTC is added to an account wallet, it can then be transferred to a trading account where Bitcoin can be used as collateral for margin positions on Bitcoin, EOS, Litecoin, Ethereum, and more. Caltex Pro Minerss also offered Bitcoin-based contracts for traditional assets for the most flexibility possible anywhere.

By utilizing leverage on Caltex Pro Minerss, traders can maximize the opportunity for profit, and can bolster BTC holdings considerably. It is important, however, to spend some time learning how to trade and protect capital against risk. Caltex Pro Minerss offers several in-depth guides on the subject on the company blog section.

Conclusion

Bitcoin is something that everyone should consider adding to their investment portfolio. Recently, CNBC’s Jim Kramer claimed it is “irresponsible” to not own some Bitcoin at this point. Companies are buying Bitcoin, hedge funds believe in its long-term growth, and investors everywhere are scrambling for a piece of the ultra-scarce cryptocurrency.

Now that you know everything there is to know about buying a Bitcoin online , do you really want to miss out on this opportunity? Buy Bitcoin from Caltex Pro Minerss today – the very best way to buy Bitcoin online.

How do you buy bitcoin?

You can buy Bitcoin in a few clicks on Caltex Pro Minerss. In the website’s deposit section, there is a separate area for alternative deposits. There, users can buy BTC directly using a credit card or debit card and fund their trading account to trade BTC.

Where to buy bitcoins?

You can buy Bitcoins on Caltex Pro Minerss or any crypto exchange or trading platform that offers it. Several peer-to-peer platforms also exist. It is not wise to buy Bitcoins in person, as there’s no way to verify transactions in person, and any cash could be at risk.

Where can I spend my bitcoins?

The option to spend Bitcoins to buy goods or pay for services is available all over the internet. However, one must consider the potential long-term implications. For example, an early user spent 10,000 BTC on two pizzas. Today, that’s worth over $400 million USD.

How much does it cost to buy Bitcoin?

The price of one full Bitcoin fluctuates regularly, down to the minute. However, anyone can purchase any increment of Bitcoin using the smallest unit of measurement called a satoshi, named after the asset’s creator. It is also possible to buy a fraction of Bitcoin this way and not have to spend as much cash.

Is it smart to invest in Bitcoin?

Bitcoin is the best performing asset of all-time, beating the returns of Amazon, Apple, and many more, and its only just beginning. Bitcoin has already produce life-changing wealth and it will continue to do so with each new boom and bust cycle.

Risk Disclaimer:

Investing in or trading gold or other metals can be risky and lead to a complete loss of capital. This guide should not be considered investment advice, and investing in gold CFDs is done at your own risk.

The information provided does not constitute, in any way, a solicitation or inducement to buy or sell cryptocurrencies, derivatives, foreign exchange products, CFDs, securities, and similar products. Comments and analysis reflect the views of different external and internal analysts at any given time and are subject to change at any time. Moreover, they can not constitute a commitment or guarantee on the part of Caltex Pro Minerss. The recipient acknowledges and agrees that by their very nature any investment in a financial instrument is of a random nature and therefore any such investment constitutes a risky investment for which the recipient is solely responsible. It is specified that the past performance of a financial product does not prejudge in any way their future performance. The foreign exchange market and derivatives such as CFDs (Contracts for Difference), Non-Deliverable Bitcoin Settled Products and Short-Term Bitcoin Settled Contracts involve a high degree of risk. They require a good level of financial knowledge and experience. Caltex Pro Minerss recommends the consultation of a financial professional who would have a perfect knowledge of the financial and patrimonial situation of the recipient of this message and would be able to verify that the financial products mentioned are adapted to the said situation and the financial objectives pursued.