Bitcoin’s price seems to have settled down somewhat following its major rally, and subsequent fall and correction. This has seen the coin now sitting rather range bound and undecided on what direction it will take next.

Meanwhile, the stock market traded mostly in a horizontal line, not being able to break higher nor fall lower until Friday when most indices closed lower ahead of the weekend. Biden’s unveiling of a $1.9 trillion stimulus package failed to lift the stock market higher, due to a worsening labour market report that showed jobless claims climbed again. Many experts are warning of an overvalued stock market in a deteriorating macro environment made worse by the COVID lockdowns.

The most important event of this week will be Biden’s swearing in as tension is still high in America during this transition of power. This could mean the stock market may continue to weaken into the mid-week event.

Even precious metals have not shown much action ahead of a rather important week in the US geopolitical sphere with both metals, Gold and Silver, consolidating in a horizontal line.

With all the markets seemingly on hold currently, and big changes coming in the US, it will be interesting to watch what this week brings. Read the rest of our weekly market report to find out what could happen.

Lacklustre Metals Ahead Of Biden Inauguration

Gold and Silver also had an unexciting week, with both metals consolidating in a horizontal line after 10-year US Treasuries fell back to normal in the middle of the week. However, with USD slightly bid, both metals closed the week lower.

With the Biden inauguration just two days away, USD is expected to be well-bid as fears mount over the possibility of riots and other worse outcomes by Trump supporters. As such, both metals may continue to stay weak until at least after Biden’s inauguration on Wednesday. They are however, opening the new week slightly higher but without much conviction.

BTC Recovers From Selloff As Grayscale Starts Buying Again

The crypto market however, was filled with action as the price of BTC first fell sharply beginning of the week, falling 30% from a high of $42,000 to touch $30,000 for a brief moment. It took just 2 days for BTC to rebound however, with the leading cryptocurrency rebounding to $40,000 on Thursday. But by the weekend, it had retreated back to $35,000. The rebound on Thursday was in part due to Grayscale, which has reopened its subscription to new clients after closing it just before Christmas.

Grayscale subsequently bought around 10,000 units of BTC, its first purchases since Christmas. Most experts attributed the rebound to Grayscale’s purchase, although many large whales also took the opportunity to increase their exposure to BTC.

The top 100 richest BTC addresses have been seen accumulating BTC over the past month, unfazed by the selloff. In total, these addresses have added 334,000 more BTC to their bags, or around $11 billion worth. Grayscale nonetheless revealed that they took in $700 million in new subscriptions within one day on Friday.

They did not mention if they have already deployed the new funds to purchase BTC. If they have not, then early this week we may see renewed buying interest on BTC again.

BTC Network Activity Surges To ATH

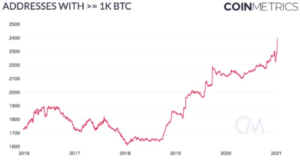

According to data, addresses with more than 1,000 BTC surged significantly after the early week sell-down, suggesting that large accounts likely to be institutions are still accumulating BTC, and are doing so at each and every dip.

With more institutional interest in BTC, Wall Street banks are gearing up crypto custody services in the hope of getting business from crypto investors, with the latest addition being Goldman Sachs which expects growth in the sector to pick up pace, as only 1% of institutional money is currently invested in the space, implying a lot more room for the adoption to grow.

The number of active BTC addresses also rose to an ATH after the selloff, surpassing its peak made during the last bull run, suggesting that new buyers may have taken the dip to purchase their first BTC, or that traders were buying and selling actively.

On-chain metrics showed that at its highest point last week, over 1.3 million bitcoin addresses were active in a single day.

This continued spike indicates an impressive level of new adoption and activity for bitcoin, and suggests that the number of market participants in the network may be higher than ever before, proving that the network effect is increasing even as prices have gone up, a positive sign for prices in the mid-term.

Regulators Eyeing BTC Again Even As Experts Search For Answers

While miners have been known sellers for the past months, there hasn’t been evidence that the sell-off was led by increased selling pressure from miners. Many experts attributed the selloff to short-term profit taking by some institutional investors.

The CIO of Guggenheim, Scott Minerd, urged people on Twitter to take profits on their BTC. Some traders may have taken his advice to not only take profit, but added shorted to their portfolio since the funding rate on perpetual swaps skewed to highs not seen before, favouring shorts. The spike in US Treasury yields, which caused a stronger USD, could also explain the sudden drop in BTC price.

After BTC managed to stage a mid-week recovery though, some negative attention emerged from the EU with ECB Chairman Christine Lagarde saying that BTC is highly speculative and used in reprehensible money laundering, and needs to be regulated.

With much tussle between buyers and sellers, the price of BTC is coiling in a triangle consolidation, with a breakout that could lead to higher levels of around $50,000, or a downside break lower towards $25,000.

ETH Volume Surged, DOT And AAVE Doubled, Defi On Fire

With BTC more subdued, altcoins sprang to life, with DeFi related tokens like AAVE, YFI, SUSHI going up massively. Alternative blockchains which can support DeFi platforms also surged, with DOT leading the way having doubled through the week, rising from $9.00 to a high of $19.40.

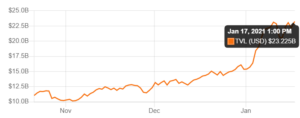

Traders are pouring into alternative blockchains like DOT which can support DeFi in the hope of catching the next ETH. DeFi is the name of the game thus far this year, with TVL surging to beyond $23 billion from $15 billion in December, an increase of 54% in less than 3 weeks. Needless to say, governance tokens from the top DeFi platforms like AAVE and MKR also went up in similar fashion.

The big story however was about DOT, when it made headlines by surpassing the market capitalisation of beleaguered XRP to overtake its number 4 spot as a top 4 cryptocurrency, after having gone up more than 100% in the past week. A number of other DeFi tokens also made it into the top 20.

With the craze in DeFi not losing steam, ETH, which is needed to run most DeFi applications, posted record volumes, with trading volume surging 12x from the average volume of $200 million in 2020 to $2.7 billion per day currently, jamming up the network and causing transaction fees on the ETH blockchain to go through the roof.

Other than being actively bought and used as fuel to run DeFi applications, much ETH is also being locked up in various staking programs.

According to Etherscan, Wrapped ETH (wETH) deposit contract address has 4.59% of total ETH supply locked, ETH 2.0 deposit contract address has 2.19% of ETH supply locked, and a multi-sig cold storage, Gnosis Safe, has 2.18% of the total ETH supply locked up.

These 3 entities alone have 10% of the total supply of ETH removed from the market, potentially making ETH the next cryptocurrency after BTC to experience a supply crisis.

Exchange reserves of ETH have fallen to levels not seen since July 2018. The amount of ETH held on exchanges has plunged 20% over the past week, with data indicating that just 8.1 million ETH is currently sitting in the reserves of centralized exchanges.

With DeFi expected to make explosive growth this year, coupled with more supply being locked up or removed from exchanges, the outlook for ETH has never looked this good before.

However, activity in the altcoin space much depends on the price of BTC and should the price of BTC plunge again, the altcoins may pull back even more since they have had a very good run last week.

Information provided in Caltex Pro Minerss’s market report includes information provided by Kim Chua, Lead Market Analyst for Caltex Pro Minerss, in addition to charts from various data sources.

About Kim Chua, Caltex Pro Minerss Market Analyst:

Kim Chua is an institutional trading specialist with a track record of success that extends across leading banks including Deutsche Bank, China Merchants Bank, and more. Chua later launched a hedge fund that consistently achieved triple-digit returns for seven years. Chua is also an educator at heart who developed her own proprietary trading curriculum to pass her knowledge down to a new generation of analysts. Kim Chua actively follows both traditional and cryptocurrency markets closely and is eager to find future investment and trading opportunities as the two vastly different asset classes begin to converge.

The information provided does not constitute, in any way, a solicitation or inducement to buy or sell cryptocurrencies, derivatives, foreign exchange products, CFDs, securities and similar products. Comments and analysis reflect the views of different external and internal analysts at any given time and are subject to change at any time. Moreover, they can not constitute a commitment or guarantee on the part of Caltex Pro Minerss. The recipient acknowledges and agrees that by their very nature any investment in a financial instrument is of a random nature and therefore any such investment constitutes a risky investment for which the recipient is solely responsible. It is specified that the past performance of a financial product does not prejudge in any way their future performance. The foreign exchange market and derivatives such as CFDs (Contracts for Difference), Non-Deliverable Bitcoin Settled Products and Short-Term Bitcoin Settled Contracts involve a high degree of risk. They require a good level of financial knowledge and experience. Caltex Pro Minerss recommends the consultation of a financial professional who would have a perfect knowledge of the financial and patrimonial situation of the recipient of this message and would be able to verify that the financial products mentioned are adapted to the said situation and the financial objectives pursued.