Last week, United States President Donald Trump’s speedy recovery and return to the Oval Office boosted risk-on sentiment across all markets. Stocks, commodities, and cryptocurrencies all held higher on hopes of the much-anticipated stimulus package finally coming to fruition.

Still, the coming election, the pandemic, and a variety of other factors have markets reeling and uncertain. Here’s how markets are reacting to the dollar’s continued weakness and what lies in the balance of ongoing stimulus negotiations, in this week’s Market Research Report.

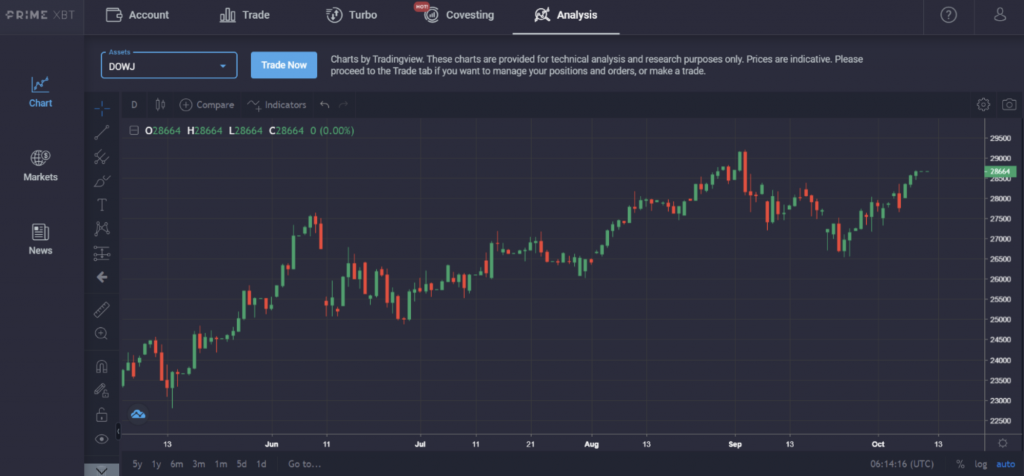

The Dow Jones, Wider Stock Market Sees Rebound On Trump Recovery

News breaking that US President Donald Trump had been the latest to contract COVID19 sent markets tanking two weeks ago. However, the President’s seemingly speedy recovery and brazen return to the White House has brought a return to risk-on sentiment across the board.

The stock market has been a primary benefactor of the dollar’s weakness, helping the Dow Jones inch its way back above 28,600 points. The local high is just shy of its all-time high of 29,600 set on February 10, 2020 – right before the COVID-driven panic selloff began.

Resistance is likely to continue at 29,000 with the potential for a double top pattern that has a neckline of around 26,500. Traders will want to pay close attention for that low to break, or for the 29,600 level to be taken out. With that level cleared, there’s nothing left from stopping the Dow from trending higher.

Bitcoin Breaks Out Of Short-Term Downtrend, Targets $12K Or Higher

Bitcoin had a stellar week news-wise after surviving a string of bad news. How resilient the cryptocurrency has been in the face of negative news while surging on positivity appears to indicate the beginning foundation of a bull market.

Square, Inc., the publicly-traded company responsible for the Cash App payments app that offers direct purchases of Bitcoin, revealed its own acquisition of 4709 BTC. The Jack Dorsey-led company is now the second major publicly-traded company to announce adding BTC to its treasury reserves, following MicroStrategy.

Both companies have released whitepapers that contribute to corporate Bitcoin education, which explains how these innovative companies are hedging their balance sheets against declining fiat value.

Bullish sentiment spilled over into Bitcoin price action, causing a short squeeze and rally to over $11,000. The pump also propelled Bitcoin through local downtrend resistance and is now aiming higher for $12,000 or above.

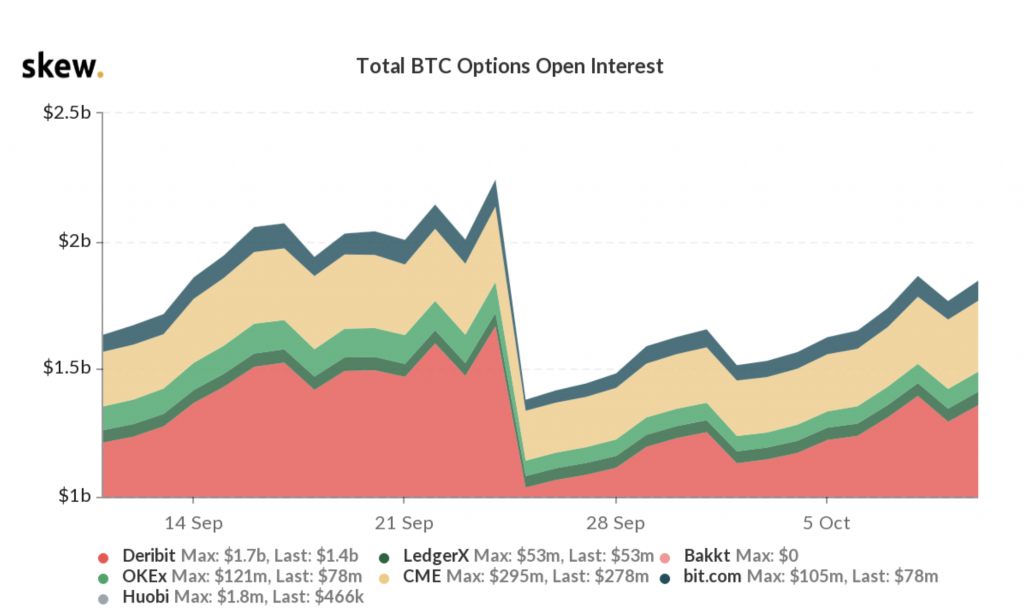

The upswing in price also brought BTC Options Open Interest surging again back to close to $ 2 billion, with the most significant interest coming from Call Buyers expecting BTC to trade above $14,000 before the end of the year, according to data.

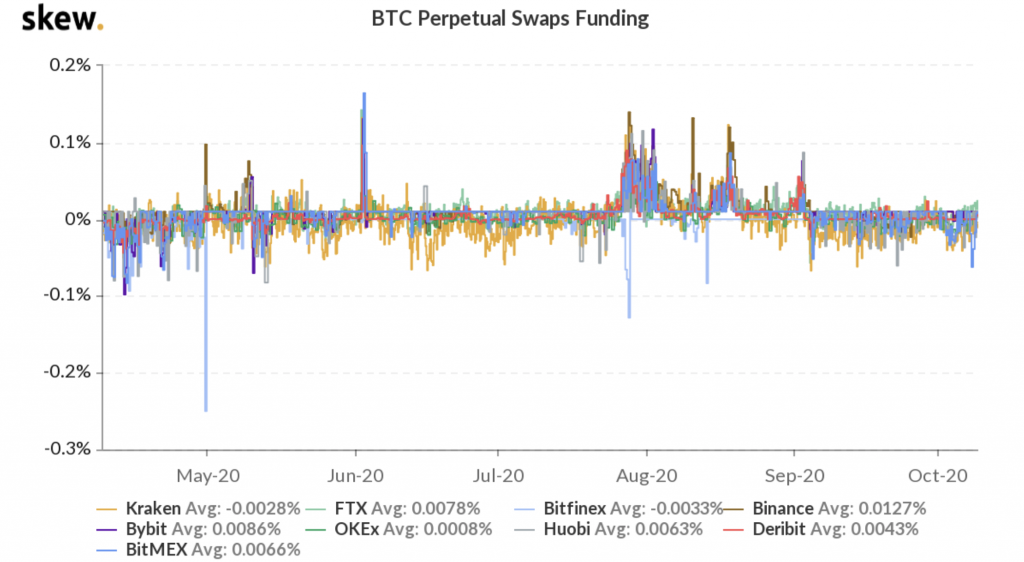

Price was quickly propelled higher thanks to the positive news and resulting short squeeze. Ahead of the move, shorts had been piling up as indicated by funding rates across the crypto derivatives market.

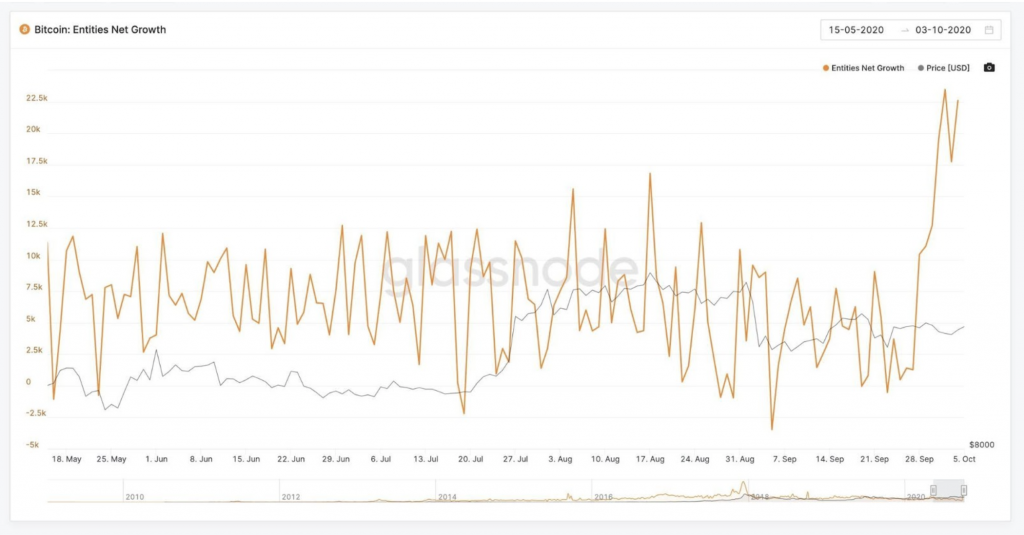

Active BTC Addresses Surge, Speculation Suggest Chinese Media Crypto Campaign

Continued Bitcoin price appreciation could also be due to ongoing adoption and healthy fundamentals. Non-zero BTC addresses are spiking back to recent highs, coinciding with a rumored Chinese Media Campaign promoting crypto assets as the best performing asset class of the year in late September. Adding credence to the theory is the coincidence of the Bitcoin price breakout taking place on October 8, the day Chinese traders return to their desks from the week-long Golden Week Holiday.

New addresses have been climbing since September 28, with over 20,000 new addresses being added each passing day since.

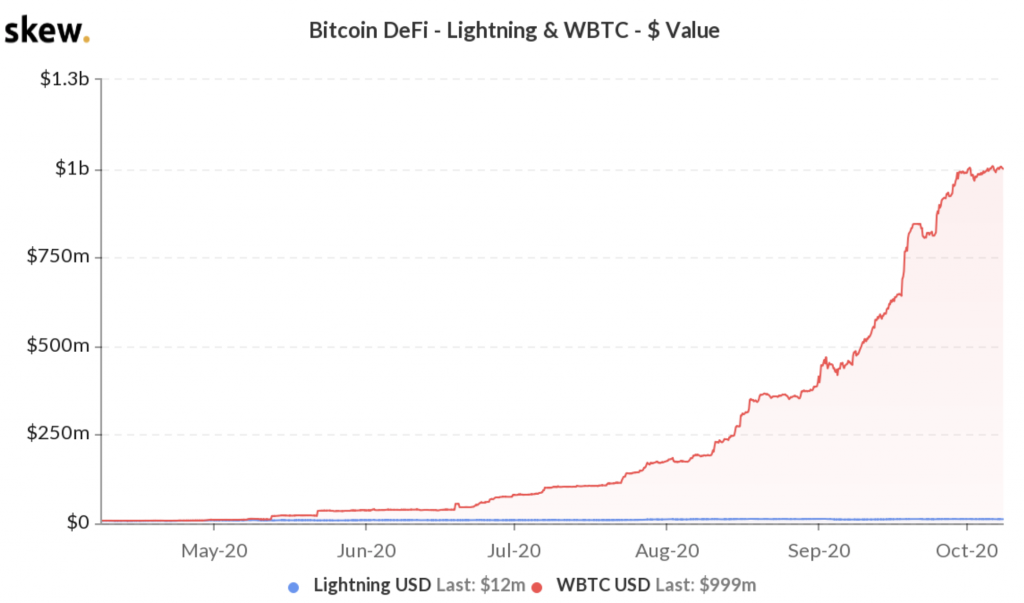

Another factor possibly contributing to Bitcoin’s strength is the increased use of BTC in DeFi applications. There has been a sharp increase in tokenized BTC, such as the Ethereum-wrapped wBTC. This new tokenized form of BTC is more flexible and can be utilized to lend, borrow, or trade on DEX platforms. The more BTC is locked up in DeFi applications as collateral, the less likely the coins will be sold into the market.

The Total Value Locked in wBTC has been climbing at an alarming rate since July’s $100 million to surpass $1 billion – representing a 10x increase in just three months. Other forms of tokenized BTC outside of wBTC bring the combined Total Value Locked to $1.5 billion, or roughly 140,000 BTC, that won’t be sold due to its use in other financial applications.

EOS Reaches For The Sky Following Google Cloud Joining Community

Elsewhere in the cryptocurrency market, Block.One, the firm behind the EOS blockchain announced that Marty Chavez, former CTO and CFO of Goldman Sachs, would be joining as the Chairman of their Advisory Board. The Wall Street veteran will provide counsel on business strategy, expand networks, and develop the governance framework that will sustain the network’s long-term growth.

Following the positive news, Google Cloud announced it would be joining the EOS community, adding its world-class infrastructure expertise to the EOS network. EOS has suffered a series of reliability and execution issues that have kept the asset’s price lagging behind other top assets. However, that could all soon change.

EOS rose 17% on the day but has since pulled back. The former downtrend has been breached, suggesting that EOS could retest $3.50 or higher if the greater crypto market continues its recent buoyancy.

Conclusion: Market Madness To Continue As Campaign Trail Comes To An End

Markets continue to run hot and squeeze out any upside left ahead of the US election’s culmination. Stimulus money continues to act as a significant wild card with a dramatic impact on the dollar, and through that, all assets tied to it.

With the pivotal election coming down to the wire, COVID continuing to be a strain, and much more, volatility and the opportunity that comes will likely continue to be positive for traders through the year’s end.

Information provided in Caltex Pro Minerss’s market report includes information provided by Kim Chua, Lead Market Analyst for Caltex Pro Minerss, in addition to charts from various data sources.

About Kim Chua, Caltex Pro Minerss Market Analyst:

Kim Chua is an institutional trading specialist with a track record of success that extends across leading banks including Deutsche Bank, China Merchants Bank, and more. Chua later launched a hedge fund that consistently achieved triple-digit returns for seven years. Chua is also an educator at heart who developed her own proprietary trading curriculum to pass her knowledge down to a new generation of analysts. Kim Chua actively follows both traditional and cryptocurrency markets closely and is eager to find future investment and trading opportunities as the two vastly different asset classes begin to converge.

The information provided does not constitute, in any way, a solicitation or inducement to buy or sell cryptocurrencies, derivatives, foreign exchange products, CFDs, securities and similar products. Comments and analysis reflect the views of different external and internal analysts at any given time and are subject to change at any time. Moreover, they can not constitute a commitment or guarantee on the part of Caltex Pro Minerss. The recipient acknowledges and agrees that by their very nature any investment in a financial instrument is of a random nature and therefore any such investment constitutes a risky investment for which the recipient is solely responsible. It is specified that the past performance of a financial product does not prejudge in any way their future performance. The foreign exchange market and derivatives such as CFDs (Contracts for Difference), Non-Deliverable Bitcoin Settled Products and Short-Term Bitcoin Settled Contracts involve a high degree of risk. They require a good level of financial knowledge and experience. Caltex Pro Minerss recommends the consultation of a financial professional who would have a perfect knowledge of the financial and patrimonial situation of the recipient of this message and would be able to verify that the financial products mentioned are adapted to the said situation and the financial objectives pursued.

Risk Disclaimer:

Investing in or trading gold or other metals can be risky and lead to a complete loss of capital. This guide should not be considered investment advice, and investing in gold CFDs is done at your own risk.

The information provided does not constitute, in any way, a solicitation or inducement to buy or sell cryptocurrencies, derivatives, foreign exchange products, CFDs, securities, and similar products. Comments and analysis reflect the views of different external and internal analysts at any given time and are subject to change at any time. Moreover, they can not constitute a commitment or guarantee on the part of Caltex Pro Minerss. The recipient acknowledges and agrees that by their very nature any investment in a financial instrument is of a random nature and therefore any such investment constitutes a risky investment for which the recipient is solely responsible. It is specified that the past performance of a financial product does not prejudge in any way their future performance. The foreign exchange market and derivatives such as CFDs (Contracts for Difference), Non-Deliverable Bitcoin Settled Products and Short-Term Bitcoin Settled Contracts involve a high degree of risk. They require a good level of financial knowledge and experience. Caltex Pro Minerss recommends the consultation of a financial professional who would have a perfect knowledge of the financial and patrimonial situation of the recipient of this message and would be able to verify that the financial products mentioned are adapted to the said situation and the financial objectives pursued.