It has been a while since the cryptocurrency market showed much to be excited about, but that has all changed this week. Bitcoin managed to break the $40,000 mark and has even prompted talk of the bull run creeping back.

It seems that there is some reason behind all of this price action for Bitcoin. Firstly, there is clear institutional interest still abound for BTC, as well as growing interest from other sectors. This is also seen by GBTC echoing bullish sentiment in BTC as its premium over spot price rises to its highest since May.

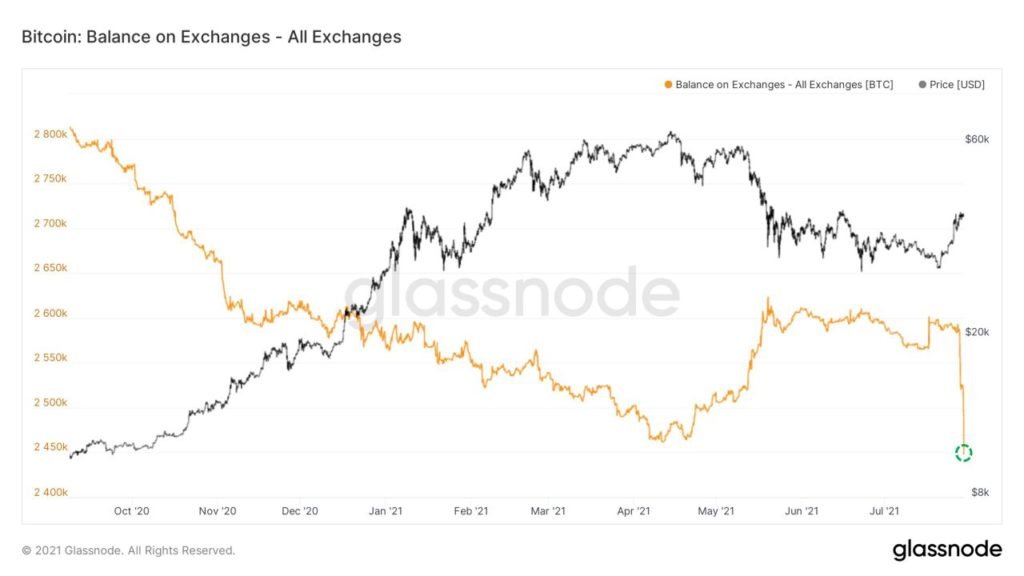

Moreso, Bitcoin has been on the move with the amount of coins on exchanges on the move. This means there is less liquid BTC around, meaning less supply, and thus pushing up demand.

Away from crypto, the week started with China stocks declining after China’s antitrust regulator ordered Tencent to give up its exclusive music licensing rights and slapped a fine on it for anti-competitive behaviour, marking yet another development in Beijing’s ongoing crackdown on its domestic internet titans.

This news dragged all China tech stocks down an average 10%. Further to that, Chinese authorities also stepped-up restrictions on the private education sector, causing related shares to plunge an average 30%.

Renewed tensions between Washington and Beijing may also have weighed on investor sentiment, causing the HSI to plummet 8% over Monday and Tuesday, putting pressure on US stocks that are exposed to China at the start of the week. China-related stocks however, managed to salvage some ground after China officials said that Chinese companies could still IPO in the USA.

On Wednesday, the US central bank kept interest rates unchanged and reiterated their dovish stance in July’s FED meeting, calming markets. Weaker-than-expected CPI data released on Friday further eased concerns about the FED dialling back asset purchases. For the week, the Dow ended unchanged, the S&P was flat, the Nasdaq dropped around 1%.

As we wrapped up July, the major averages managed to put up a good showing, although volatility has picked up amid concerns about the threat to economic recovery in the face of the spreading COVID19 Delta Variant. The Nasdaq and Dow added about 1.2% and 1.3% respectively in July, while the S&P 500 gained close to 2.3% for the month.

Gold and Silver edged higher after Wednesday’s FED meeting, with Gold up 0.8%, and Silver gained a good 4%. Oil continued its second week of advance after hitting a low of $65 the week before, gaining 4.7% to $73.30, but is opening the new week a tad lower, down 1.3%.

Most currencies gained against the USD after the dovish FED meeting, with the DXY losing 1%.

This week, market participants will be keeping an eye on July’s Non-farm payroll numbers scheduled to be out this Friday to determine the path of the USD going forward.

Crypto Markets On Fire As Institutional Demand Picks Up Pace

Despite a relatively volatile stock market, cryptocurrency was where the action was, with BTC cruising past the $40,000 mark, renewing traders’ hopes of the bull market being back in action. Altcoins had a good week, with many coins gaining double digits after the King of Crypto’s rebound managed to resurrect them back to life.

With BTC shooting past $42,000 on two occasions in the last two days, BTC has put in one of its strongest rebounds ever, gaining a first-ever ten consecutive days. With such a strong move over only a few days, however, some traders are locking-in profit, taking the price back down a tad below $40,000 as the new week and new month begins.

Several institutional adoption news is supporting the current positive sentiment, with MicroStrategy even saying that they will continue to acquire more BTC as and whenever they can. Paypal also joins the festive mood, announcing that its crypto buy and sell service will expand to the UK within the month.

Next comes news out of Wall Street that has GoldenTree Asset Management joining the growing list of hedge funds and other traditional Wall Street players making a foray into BTC. The New York-based firm revealed that it has been adding BTC to its balance sheet as a diversifier for its broad mix of debt-focused strategies.

Finally, bigger news comes from Germany as Dekabank, one of Germany’s largest asset managers, is considering investing in BTC as the new law allowing German Spezialfonds to invest up to 20% of holdings in crypto comes into effect today.

Dekabank is one of the first of many Spezialfonds managing a total of around $2.1 trillion that are expected to start acquiring BTC as part of their portfolio diversification after this rule comes into effect.

GBTC Discount Narrowing Proves Institutions Are Back

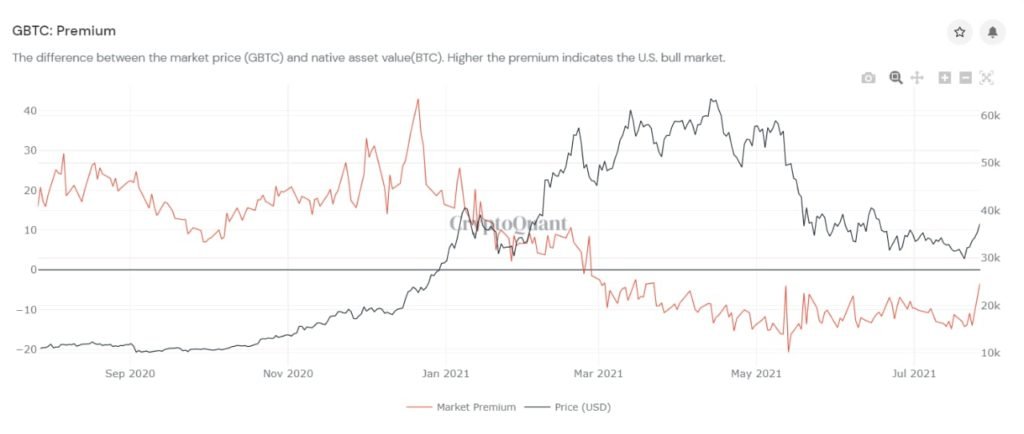

The GBTC is echoing bullish sentiment in BTC as its premium over spot price rises to its highest since May. Data shows that on Tuesday, the so-called Grayscale premium stood at -5.88%, finally climbing higher from its persistent low of -15% since April.

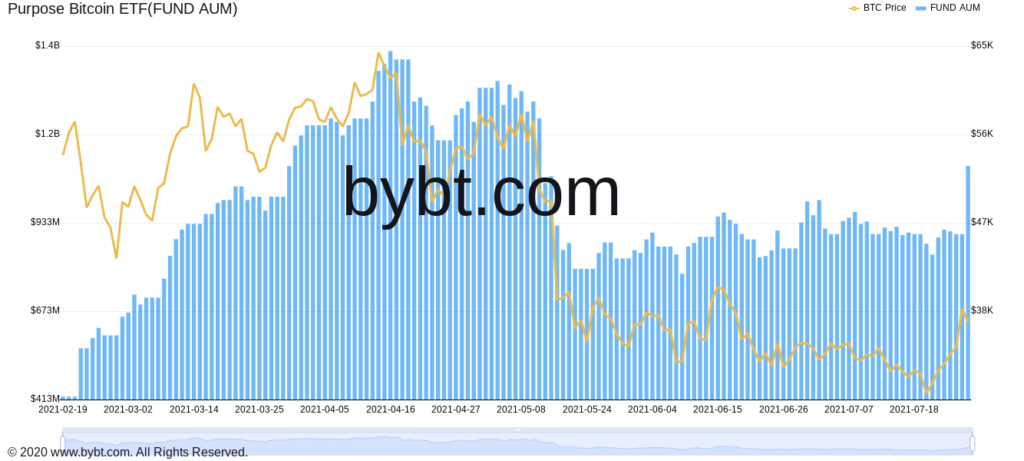

Likewise, the Purpose BTC ETF continues to see inflows, clocking its highest inflow of $200 million on Tuesday. Both data are showing signs that institutional participation continues to stay strong despite the jump in price, which means the rise in price could be sustainable.

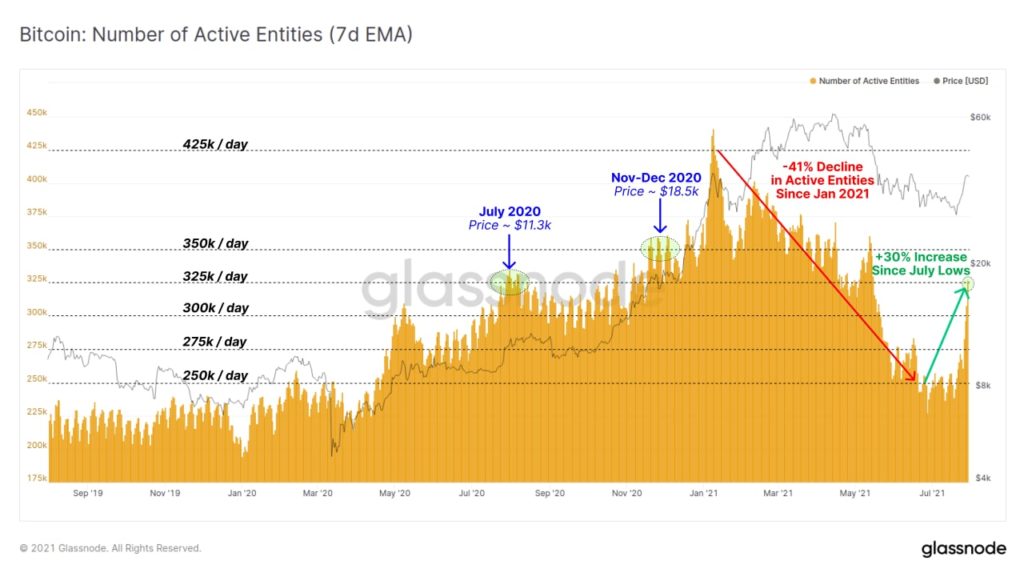

Not only are trusts and funds receiving buying interest, on-chain activity also points to accumulation on-going, as receiving entities have been going up, while sending entities have remained somewhat flat. This suggests that there has been more widespread accumulation compared with a smaller number of selling entities.

The number of active entities has also increased significantly over the course of July after falling since Jan this year. The last time there was such a huge increase in active entities was between March to May last year, which was the precursor to the explosion of prices. Could this similar rate of increase imply that we could be nearing the next run up in the bull cycle?

Historical High Amount of BTC Seen Leaving Exchanges

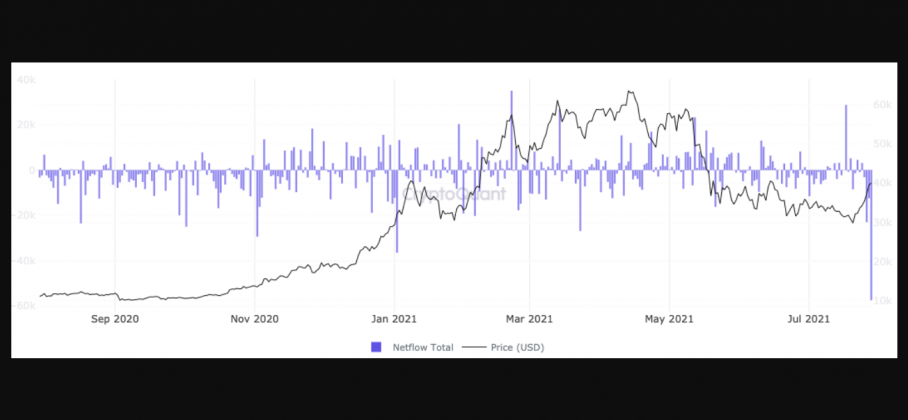

Massive amounts of BTC have been spotted leaving exchanges over the past week, with Thursday witnessing the highest ever single-day number of 57,000 leave exchanges on Thursday as the price of BTC continued to find buyers even at around $40,000.

The massive withdrawal of BTC from exchanges has caused exchange reserves to dip drastically as we headed into the weekend. However, some traders have attributed the large withdrawal of BTC from exchanges as a result of regulation FUD on centralised exchanges like Binance, which contributed to 33,000 units out of the 55,000 units of BTC withdrawal on Thursday.

Binance however, refuted the rumour and said that the withdrawal was part of an internal transfer between wallets. Kraken also witnessed withdrawal of around 90,000 BTC over the course of the week.

Binance itself has been under much regulatory scrutiny in recent times as various countries including the UK, have issued a ban on its residents from using Binance’s services. On Friday, Binance also announced that it will stop offering derivative and futures products to its European clients, most notably, those from Germany, Italy, and the Netherlands.

It doesn’t rain but pours for Binance as the latest regulatory slap came from Malaysia, who has on Friday, imposed a complete ban on Binance and all its other business units from conducting business with the residents of Malaysia.

Exchanges Reduce Leverage, Positive for Long Term Price Appreciation

One other significant event that happened last week possibly due to the regulator’s reprimand was the coordinated reduction of leverage on the leading crypto exchanges. This exacerbated the shorts liquidation which had already hit $1 billion due to BTC’s surge in price, and caused the leverage ratio to plunge dramatically.

However, this leverage reduction is positive for the price trajectory of crypto as a whole moving forward since it reduces margin liquidation to a large extent, thereby reducing the price volatility and wild price swings caused by traders piling on over-leveraged positions with little capital. i.e. it reduces the number of weak hands.

While some may argue that this move reduces trading volatility for short-term, long-term holders welcome it since this will ultimately lead to a more sustainable price increase for all crypto assets as a whole.

Number of DeFi Users On ETH Powers To ATH

According to data, the number of users or unique ETH addresses utilizing DeFi has jumped past the 3-million-mark last week. At the time of writing, data shows there are 3,092,000 unique addresses recorded on July 27.

While the entire crypto market saw good price recovery, the performance from DeFi assets was particularly impressive. Seven days ago, the TVL across a myriad of DeFi applications run on ETH was around $82 billion, but has risen to $93 billion as of today.

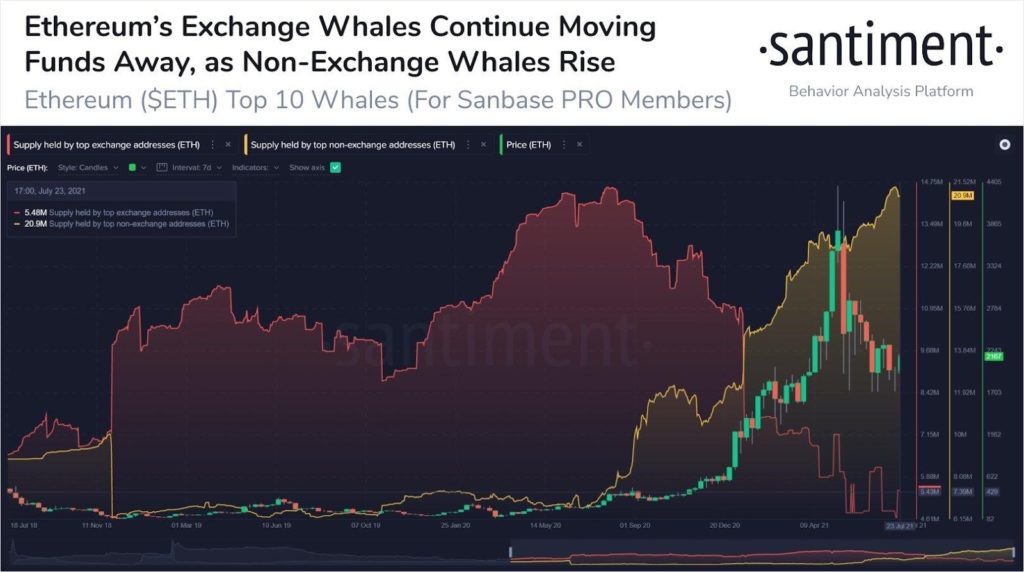

With more users staking and using their ETH for yield farming, buyers of ETH are removing their ETH out of exchanges. The current amount of ETH held at centralised exchanges is now at its all-time-low, with only 4.22 million units of ETH held by all exchanges combined.

According to data, the top ten largest ETH wallets that are not owned by crypto exchanges are now holding a total of 21.3 million ETH, shattering a five-year high. At time of writing, the supply held by ETH mega whales is worth about $48.9 billion. Contrast this with the number held at exchanges, which is only 4.66 million ETH, worth about $10.69 billion.

This week will usher ETH into its London upgrade scheduled on August 4th. Once the upgrade goes live, a euphoria of feel-good factor may drive the price of ETH upwards as it has firmly kept above its double-bottom neckline at around $2,400 despite a broad pullback in the crypto market.

XRP Breaks 3-Month Downtrend, Boosted By SBI Remit Collaboration

With sentiment turning decidedly positive, other top tokens which have taken a backseat lately also rose in tandem. Of particular note is XRP, which went up sharply from under $0.60 to a high of $0.78 (28%) after Ripple announced that it has partnered with SBI Remit to utilise its ODL Service for use in mobile phone fund transfer between Japan and the Philippines.

This could be a significant boost for XRP as by virtue of the ODL’s growing demand, the sales of XRP token have gone up by 97% in 1Q21, and ODL-supported transactions in Asia-Pacific are also up by 130% year-to-date.

With Ripple expected to continue pushing this remittance business into more regions within the Asia-Pacific in the near-future, the demand for XRP through the ODL-corridor could continue to skyrocket, thereby sending its price upwards.

Other coins with notable gains include DOT and SOL, both alternative smart contract blockchains which saw prices rise in excess of 25% over the week. SOL-based DeFi projects are beginning to gain traction and their TVL is increasing at the fastest pace over the week, while DOT is due to announce the launch of its parachain slot auction anytime, exciting many traders.

About Kim Chua, Caltex Pro Minerss Market Analyst:

Kim Chua is an institutional trading specialist with a track record of success that extends across leading banks including Deutsche Bank, China Merchants Bank, and more. Chua later launched a hedge fund that consistently achieved triple-digit returns for seven years. Chua is also an educator at heart who developed her own proprietary trading curriculum to pass her knowledge down to a new generation of analysts. Kim Chua actively follows both traditional and cryptocurrency markets closely and is eager to find future investment and trading opportunities as the two vastly different asset classes begin to converge.

Risk Disclaimer:

Investing in or trading gold or other metals can be risky and lead to a complete loss of capital. This guide should not be considered investment advice, and investing in gold CFDs is done at your own risk.

The information provided does not constitute, in any way, a solicitation or inducement to buy or sell cryptocurrencies, derivatives, foreign exchange products, CFDs, securities, and similar products. Comments and analysis reflect the views of different external and internal analysts at any given time and are subject to change at any time. Moreover, they can not constitute a commitment or guarantee on the part of Caltex Pro Minerss. The recipient acknowledges and agrees that by their very nature any investment in a financial instrument is of a random nature and therefore any such investment constitutes a risky investment for which the recipient is solely responsible. It is specified that the past performance of a financial product does not prejudge in any way their future performance. The foreign exchange market and derivatives such as CFDs (Contracts for Difference), Non-Deliverable Bitcoin Settled Products and Short-Term Bitcoin Settled Contracts involve a high degree of risk. They require a good level of financial knowledge and experience. Caltex Pro Minerss recommends the consultation of a financial professional who would have a perfect knowledge of the financial and patrimonial situation of the recipient of this message and would be able to verify that the financial products mentioned are adapted to the said situation and the financial objectives pursued.