Despite Bitcoin being over 10 years old, the cryptocurrency space has only recently burst onto the scene and has found itself on the lips of almost everybody worldwide. With that, many people want to know how to make money with cryptocurrency. Cryptocurrency has become so attractive because it is a many-faceted ecosystem that provides vast financial freedom making it possible for individuals to invest, accrue dividends, spend money, do day trading, send value across borders, and many other things.

More so, the reason that cryptocurrencies have become so popular is because they allow people to make money off Bitcoin. There are many top ways to earn by investing in Bitcoin such as mining, holding, day trading, staking, lending, earning commission, and many more.

We will be looking at 10 different ways of making money with cryptocurrency that prove it is not only easy for people to make money in the crypto industry, but it is possible for almost anyone to be successful when they decide to invest in the crypto ecosystem.

1. Buy and Hold

Arguably one of the most popular methods of making money in the cryptocurrency space, buying and holding, also known as “Hodl”, is also one of the easiest methods which can lead to profits. The idea of buying and holding is not unique to cryptocurrency as it is common with other assets, like stocks or shares. It simply involves buying a cryptocurrency, like Bitcoin, Ethereum, Ripple, or Litecoin, and holding onto that asset until it appreciates in value. From there, you can decide to sell it and take the profit.

The reason this method is so popular is because Bitcoin is the best performing asset of the past decade. Bitcoin, as the oldest, and biggest cryptocurrency, has made gains of 9 million percent in 10 years; there is no other asset on earth that has competed with that.

Overall, Bitcoin’s trajectory, especially over longer periods, has been in an upward direction. To put this in perspective, if you decided to buy Bitcoin in early 2017 when it started getting mentioned in mainstream media and was valued at $1,000 USD and then sold it a year later you could have walked away with as much as $19,000 USD of pure profit!

Of course, buying and holding as a method to make money still has a lot to do with timing. It all depends on how long you want to hold Bitcoin for because you have not made any profit, or loss, until you sell. But, buying and holding is a good way to make money selling Bitcoin. So if you decide to sell and make 100 percent profit on your initial investment, you could be missing out on 200, 300, or even 3,000 percent profit if you held a little longer!

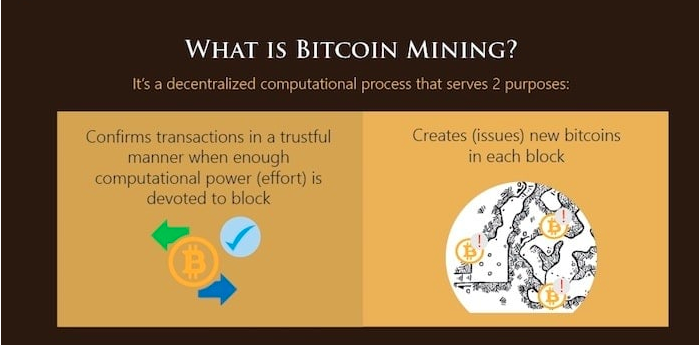

2. Mining

Mining is not only an avenue where a person can make money in the cryptocurrency space, it is an important part in the running and ongoing success of certain cryptocurrencies – such as Bitcoin. Mining cryptocurrency is considered a passive form of income as, after the initial set up, it becomes a slow accumulation of cryptocurrencies through the running of mining equipment.

Mining involves both verifying transactions onto a blockchain, as well as solving algorithmic problems to unlock new blocks and earn rewards. Both of these practices result in a way to make money for a miner.

Every transaction in Bitcoin comes with a fee that is paid to the miner that verifies the transaction to be true. Upon verifying the miner receives the fee and that miner is paid passively for doing this work. However, the more traditional method of mining involves trying to solve unlock a new block.

Mining requires specialised and often expensive equipment that has high processing power to try and solve the equation that unlocks a new block. If a miner gets the right combination to unlock a new block they are instantly rewarded with 12.5 BTC which shows how profitable this method can be.

Of course, it is difficult to be the one that unlocks a new block, and the set up fees in terms of buying mining equipment is expensive to begin with. It is also important to make note of the electricity cost as Bitcoin mining is purposefully resource intensive and there are profitability margins to consider in this passive form of income.

3. Trading

If “Holding” is a popular method to make money with cryptocurrency, and mining is a passive method to make money off Bitcoin,then trading is probably the most profitable way to make money. But, there are many ways to make money trading cryptocurrency.

Trading in cryptocurrency has become extremely popular in recent times because traders have realised that there is a lot of money to be made when trading and it has even started spilling out into traditional institutional trading settings.

Part of the reason that trading is so profitable is because Bitcoin, as an example of a cryptocurrency, is very volatile and thus the price can fluctuate up and down a lot in a single day. Therefore, good traders are able to look for patterns and predict when the price of the coin will go up – and buy before then, and then note when the price is about to fall – and sell – which leads to big profits. It is clear that with the correct trades a person can make a lot of money, but also that they can make that money quickly.

Additionally, there are a number of products and processes that allow traders to be even more agile and profitable that have come in from traditional trading settings. This includes margin trading which incorporates leveraging.

Margin trading with cryptocurrency allows users to borrow money against their current funds to trade cryptocurrency “on margin” on an exchange. In other words, users can leverage their existing cryptocurrency or dollars by borrowing funds to increase their buying power.

It is clear why this method can provide such profit as it allows traders to invest more money than they have in the hopes of making a return on that increased amount. For example, you put down $25 USD and leverage 4:1, or 4x, to borrow $75 USD to buy $100 USD worth of Bitcoin. Now you can bet on whether Bitcoin’s price is going to go up, called a long, or go down, called a short.

In this form of trading, you can leverage short or long. When you short you bet on the price going down (and if it goes up you lose money on paper). When you go long, you bet on the price going up (and if it goes down you lose money on paper).

The position doesn’t close until you close the position manually or at a set price, or the exchange calls your position in.

4. Staking Cryptocurrencies

Staking cryptocurrencies is another way to make a passive earning in the ecosystem, but it has the added benefit of also being a ‘Buy and Hold’ strategy. To understand staking, it is important to understand the different kinds of cryptocurrencies; proof-of-work, and proof-of-stake.

A proof-of-work coin is a coin like Bitcoin which requires proof of work, in this case mining, to run its network and is dependent on how much processing power one has. The alternative, which is proof-of-stake, involves the power of an individual on the network being determined by how many coins they hold.

This means that the more coins a person holds the more impact and effect they have on the network. It also means they are paid out more for their staking as this comes in the form of dividends, essentially. Staking is the process of holding funds to receive rewards, while contributing to the operations of a blockchain.

Thus, by holding these coins you passively earn money thanks to the rewards, but you are also holding onto an asset which is fluctuating in price so you are able to sell them when you want to take a profit.

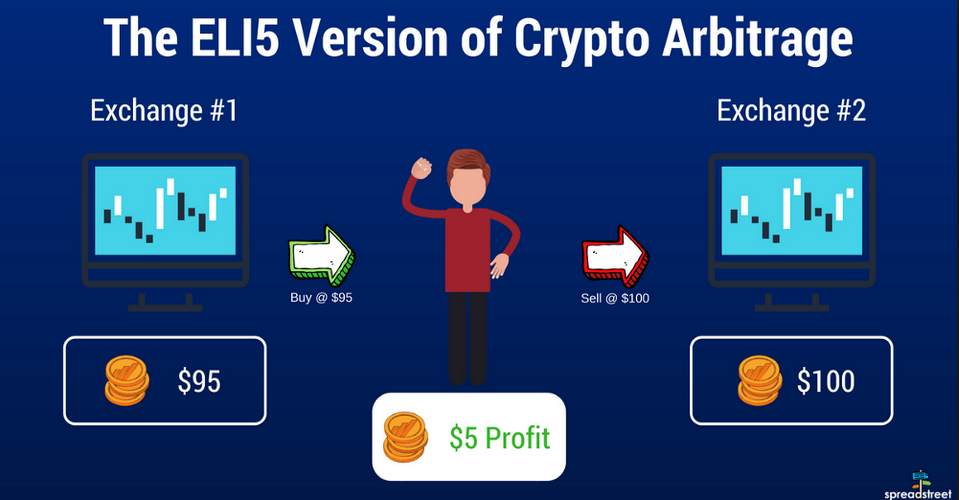

5. Currency and Exchange Arbitrage

Arbitrage is a method that allows you to take advantage of the different prices across different cryptocurrencies, and exchanges, and to buy at lower prices in one place and sell higher at another for profit. The price of cryptocurrencies is dependent on a market and thus it can vary by a few percent on different exchanges meaning there are small margins to be made here and there.

Different exchanges, different coins, and even different countries with their forex, can present arbitrage opportunities where a person can buy low and sell higher, but this does require a lot of time, effort, and planning for not very big profits.

There are some instances where a massive premium is apparent in certain countries or exchanges where arbitraging can make big profits, but these are rare occurrences. For instance, Korea has often seen what has been called a ‘Kimchi Premium’ where, for a number of reasons, Bitcoin has traded as much as $1,000 above normal market rates.

If you bought 1 BTC at $10,000 USD at say Coinbase, and then sent that to a Korean wallet and sold it on one of their exchanges for the premium price of $11,000 USD you will make an easy $1,000 USD profit.

6. Masternodes

A Masternode is a vital part of the cryptocurrency network and while it may not sound like an obvious place to earn money, it is possible – although not exactly easy. A masternode is a computer that stores the entire cryptocurrencies’ blockchain ledger and thus has a record of every transaction ever to have taken place on that blockchain, and is constantly updating.

By deciding to host a masternode, the network will pay you a certain number of coins of that cryptocurrency, however, to host a masternode you are often required to be holding a substantial amount of the cryptocurrency to even be considered.

It is also quite a tricky set up as it requires a lot of technical know-how in regards to setting up a server and the inner workings of blockchain. More information on how to set up a masternode can be found here.

7. Accepting Cryptocurrency

In recent times, the adoption of cryptocurrencies has been growing steadily. It is not only individuals who are interested in them, using them, and investing in them, it is also retailers that are now happy to receive them. This again presents an interesting way to make money with cryptocurrencies, and is one way to earn cryptocurrency, and all without even having to buy Bitcoin.

If you have some sort of store, or sell goods or a service, you could always offer a payment option in Bitcoin or another cryptocurrency, The benefit of this is that you can open up your payments to be more global as there is no border on where you can receive cryptocurrency from.

In terms of making money off of this, receiving cryptocurrency allows you to access a number of other methods explained above. If you take payment in cryptocurrency you can hold onto the currency and wait for it to appreciate and gain profit on that payment. However, if you are savvy you can turn that cryptocurrency you received into a lot more money by trading with it, especially through margin trading as you do not need as much cryptocurrency to ensure larger profits.

8. Work For Cryptocurrency

In a similar way that you can accept cryptocurrency for goods, or at an online shop you have, you can also work for Bitcoin. Taking Bitcoin as a salary is still quite niche, as there are not many places you can pay all your bills with crypto yet, but it is still an option.

There are certain companies that allow payroll to be conducted in Bitcoin and allow for employees to opt in to receiving al, or part, of their salary in Bitcoin. Bitwage is a well-established platform that provides payroll and human resource services for this day and age, when the use of digital currencies in payments is growing rapidly around the world.

Again, the advantages of taking Bitcoin as part of your salary is that you can instantly use it as a savings investment in the traditional buy and hold method. Additionally, you can use this part of your salary to trade Bitcoin in order to try and boost your monthly payment with some savvy margin trading.

9. Lending

Because things like Bitcoin operate both as a currency and an asset, and because it is digital and very liquid, it is an ideal asset for lending. If you are in a position where you hold a substantial amount of certain coins, there are a number of peer-to-peer marketplaces that allow you to lend these coins out and receive interest from it.

By lending your coins out you are not only receiving the interest from doing so, but you can also set terms that see you accumulating the gains that come with the appreciation of the price of the certain cryptocurrency.

However, because the cryptocurrency space is still relatively poorly regulated this can be a risky idea as your opportunity for recourse if things were to go wrong with your loan contract.

10. Trading Bots

Because of the popularity and profitability of trading, there have been a number of cryptocurrency trading bots that have been developed in order to try and make the process a little easier and less energy intensive.

Trading takes quite a lot of focus and attention, it can also be time consuming and require a mastery of the skill in order to be especially successful. There is a lot of learning that comes into trading, and to start out with, it may be a good idea to invest with a trading bot.

Crypto trading bots will automatically make buy and sell orders on the market at the right times using algorithms and data points. This sounds more attractive, but it is quite basic and there is a decided lack of human nuisance that is hard to bottle, or digitize.

Trading bots also lack the opportunity for you to use margin trading, and they cannot have an instinct for a trade that a human can have. Moreover, if you use one when starting out it can lead to a lack of opportunity to learn how to be a good trader.

In Summary

Of course, all of these methods are aimed at making money through cryptocurrency, but they are all very different from one another. Some require a lot more time and effort, but then can give a lot more profit and return on that effort. Others, especially the passive ones, are fairly easy to do, but they do not offer the same earning potential. Top cryptocurrencies to invest.

The table below attempts to make it easier to understand which method might work best depending on how much time you have, how difficult it is to do, and what the profitability on each of the methods is.

Of course, there are also other things to consider. For example, mining is relatively difficult as a way to earn, but that is partly because there is a high set up cost involved. Additionally, while it is passive and thus not too time consuming, there is a need to monitor the price of the coin, and the electricity costs, to ensure profitability at all time.

| Method | Difficulty | Time and Effort | Earning Potential |

| Buy & Hold | Low | Low | Medium |

| Mining | Medium | Medium | Medium |

| Trading | Medium | High | High |

| Staking | Low | Low | Medium |

| Arbitrage | Medium | High | Low |

| Masternodes | High | Low | Low |

| Accepting Crypto | Low | Low | Low |

| Working for Crypto | Low | Low | Medium |

| Lending | Medium | Low | Medium |

| Trading Bots | Medium | Low | Medium |

Conclusion

It is quite clear that cryptocurrencies offer a multitude of ways to earn money, and each method is very different from the next. Some of the methods are quite popular and easy to do, while others require a bit of work. What has become more apparent over time however is that one method sticks out above all the rest, especially when it comes to profitability.

Trading has become one of the major methods that people use to make money in cryptocurrency. There is a bit of a learning curve, but it is open and available to all, even with no experience. There are platforms out there, like Caltex Pro Minerss, that offers new traders a free account to begin with that is aimed at helping newbie traders, as well as experienced heads.

If you have at least heard of cryptocurrencies, and perhaps even bought some and held on as the most basic method of making money, it is worth exploring new methods to increase your profitability in this exciting and always growing space.

Risk Disclaimer:

Investing in or trading gold or other metals can be risky and lead to a complete loss of capital. This guide should not be considered investment advice, and investing in gold CFDs is done at your own risk.

The information provided does not constitute, in any way, a solicitation or inducement to buy or sell cryptocurrencies, derivatives, foreign exchange products, CFDs, securities, and similar products. Comments and analysis reflect the views of different external and internal analysts at any given time and are subject to change at any time. Moreover, they can not constitute a commitment or guarantee on the part of Caltex Pro Minerss. The recipient acknowledges and agrees that by their very nature any investment in a financial instrument is of a random nature and therefore any such investment constitutes a risky investment for which the recipient is solely responsible. It is specified that the past performance of a financial product does not prejudge in any way their future performance. The foreign exchange market and derivatives such as CFDs (Contracts for Difference), Non-Deliverable Bitcoin Settled Products and Short-Term Bitcoin Settled Contracts involve a high degree of risk. They require a good level of financial knowledge and experience. Caltex Pro Minerss recommends the consultation of a financial professional who would have a perfect knowledge of the financial and patrimonial situation of the recipient of this message and would be able to verify that the financial products mentioned are adapted to the said situation and the financial objectives pursued.