After the emergence of Bitcoin, several cryptocurrency projects were designed in its honor, either to carve out its own niche in the finance space, or improve upon what Bitcoin already had to offer in one way or another.

Among the first coins to take after Bitcoin were Litecoin, XRP, and others. But once Ethereum appeared, the crypto market has never been the same since. That’s because Ethereum isn’t just a payment cryptocurrency, much like the first assets to come onto the scene, it is a full-fledged supercomputer that enables smart contracts for developers to take advantage of and build decentralized applications on top of.

This eventually led to the initial coin offering boom in 2017 that saw the creation of thousands of new ERC-20 tokens built on the Ethereum blockchain. Many of these projects are worthless today, but the explosion of interest helped propel Ethereum to prices of $1,400 per token and to the top of the high volatility cryptocurrency market.

And while the ICO boom has since fizzled out, Ethereum is once again skyrocketing due to the decentralized finance craze, the growth of decentralized exchanges and liquidity swap platforms, and the emergence of the NFT market. Today, Ethereum has broken that former all-time high on the back of DeFi, and trading at more than $4,000 per token at the new peak in Q2 2021.

This guide will walk you through all the reasons why Ethereum is a good investment, how to invest in it, explain all the pros and cons of Ethereum investing, and much more.

Ethereum Investing: What Is It?

Ethereum investment is an investment in the future of finance. The smart contract platform has been positioned to replace Wall Street’s aging archaic back end and has already begun replacing company shares and bonds with tokens bound to smart contracts as part of certain business transactions.

Ethereum’s potential is possibly even more remarkable than Bitcoin’s, due to it acting as a platform for developers to continue to build and innovate on. Case and point is the recent DeFi trend. Nearly every new day, an exciting new project and addition to the world of finance breaks new ground and forever changes the industry. It’s led to the introduction of new crypto buzzwords like “yield farming” and “liquidity pooling.”

Just like before, many of these DeFi projects are scams or lack real-world use cases, but there are also plenty of diamonds in the rough. Promising DeFi projects allow for permissionless lending and borrowing, and are disrupting traditional finance.

The NFT market, or non-fungible tokens, is also extremely important to Ethereum price growth as most NFTs are built on another type of Ethereum smart contract standard. Because NFTs and DeFi all run on Ethereum, they require ETH to use as gas to pay for transactions. This requires users to buy ETH, which can help drive up Ethereum prices.

Whatever these projects end up being or whatever shape they take next, Ethereum and investors are the beneficiaries. The recent DeFi bandwagon has led Ethereum to outperform Bitcoin and nearly all other altcoins, making it one of the best investments in 2021.

Even with a new all-time high already set, Ethereum’s new uptrend may only be beginning just now, meaning that investing in Ethereum now could lead to maximum financial reward and return on investment.

Is Ethereum A Good Investment? How It Performed In 2020

2020 was the comeback year for Ethereum. And while it stopped short at setting a new all-time high until the following year in 2021, the foundation that was laid in 2020 should support ongoing price appreciation for years to come.

DeFi has since exploded to a milestone more than $90 billion in total value locked at the peak, most of it in Ethereum or ERC20 tokens built on Ethereum. The boom in DeFi and NFTs built on Ethereum, have caused demand for ETH to pay for ultra high gas fees to rise and send prices soaring. An Ethereum 2.0 update is being rolled out in phases to help with scalability, and ensuring long-term investment success.

Investing In Ethereum In 2021? Is It A Good Idea?

2021 is already off to a bullish start for Ethereum, with the coin reaching a new all-time high above $2,000 per ETH due to unprecedented demand for the token to pay for gas fees. Newcomers are out for blood, but because Ethereum’s ecosystem has grown so large, there’s very little chance of anything beating it.

Total Value Locked has achieved more than $90 billion, and Ethereum demand will only rise and supply will diminish as that continues. Nearly 25% of all ETH in circulation is now locked up in smart contracts, with a significant share related to the ETH 2.0 staking address.

Another update, dubbed EIP 1559, will theoretically impact the Ethereum supply making ETH more scarce over time. All of these factors and the realization across Wall Street that Ethereum is here to stay, could make it a more profitable investment than even Bitcoin. However, after a such as strong gain in 2020 and 2021, there’s always a chance this bullish coin has run out of steam. Only time will tell how the rest of the year performs.

Ethereum Fundamental Analysis

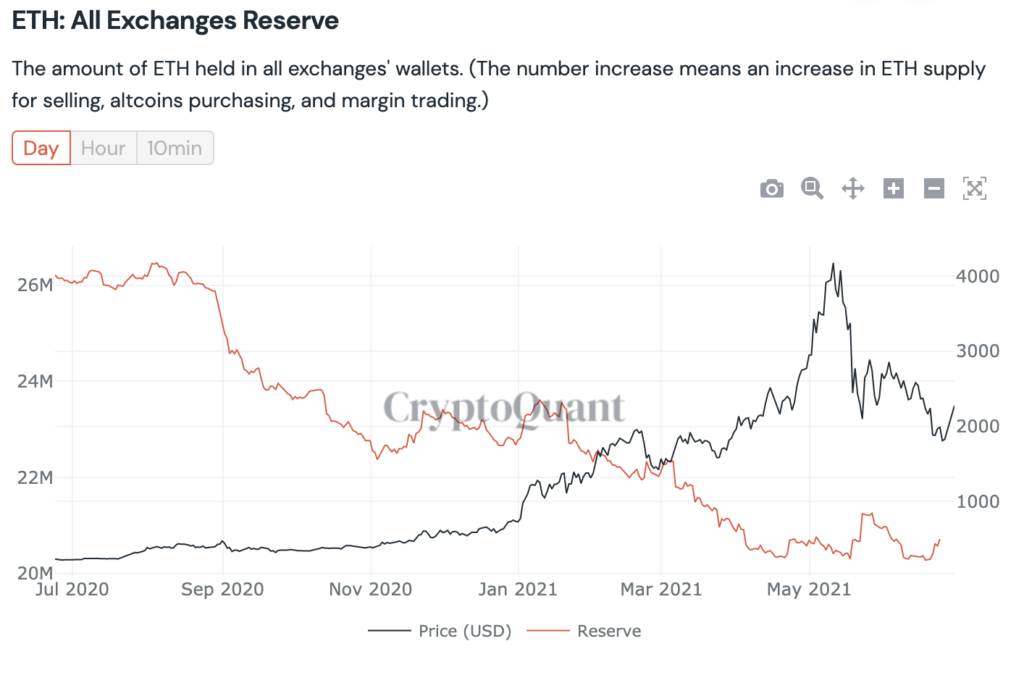

In addition to the decentralized finance trend helping to build upon Ethereum’s strong foundation of fundamentals, data shows that nearly all other metrics have grown, including total active ETH addresses. Also fundamentally, the ETH 2.0 upgrade is addressing ongoing throughput bottlenecks the network currently faces. The amount of ETH on exchanges also continues to plummet.

Ethereum Technical Analysis

Technicals also point to significant growth in the crypto asset now that a new all-time high is set. Ethereum has only recently broken above its former all-time high, and in the past, the results were fireworks for months to come.

Ethereum also appears to be forming a similar pattern as a small consolidation phase before its last leg up in the last bull market. The altcoin paused at around $400, only to explode to $14,000. Interestingly, Ether prices paused again this time around at $4,000. Will the cryptocurrency see $14,000 per coin?

Ethereum Sentiment Analysis

Because of the DeFi and NFT explosions, Ethereum sentiment hasn’t been this strong since the ICO boom in 2017 when Ethereum prices followed and ballooned to $1,400 per token.

This time around, not only is the DeFi and NFT trends are healthier and more sustainable because the movement is decentralized. Unlike the ICO trend dying out due to regulations, DeFi and NFTs are here to stay. Which is why Ethereum has beaten those highs from last cycle and is trading at more than $2,000 per coin currently and hit a high of $4,400.

Social volume, sentiment, and engagement rose significantly over the last year when shorting Ethereum was among the most profitable strategies.

Expert Expectations and Ethereum Price Predictions

Due to Ethereum’s enormous promise and potential as a technology and as an investment, experts regularly weigh in on what they expect for the asset’s performance.

For example, Simon Dedic, Co-Founder of Blockfyre and Managing Partner at Moonrock Capital, estimates Ethereum could someday be worth as much as $9,000 per coin. Even with the recent selloff, Dedic says the bear trap will still result in $9K Ethereum.

Trading desk Galaxy Trading claims that the target they’re watching for by year-end is closer to $10,000 per ETH.

Angel Investor Joe McAnn is eyeing a $50,000 target for Ethereum based on the March 2021 options contract strike price.

Anthony Sassano has the most bullish bet of all for Ethereum with a projection of more than $150,000 per coin by the year 2023.

Read more Ethereum Price Predictions

Ways To Invest In Ethereum

Although no one will ever have the chance to buy Ethereum during its token sale ever again and get in on such enormous ROI, that doesn’t mean Ethereum can’t still be an excellent investment. Back then, it was challenging to get Ethereum that early, but today it can be bought in just a few clicks online. Here are some of the most common ways to invest in Ethereum.

Buy and Hold

The buy and hold strategy is a sound, simple one, but one of the riskiest strategies for one reason: volatility. The crypto world is known for its explosive price action. For example, Ethereum at one pointed trading at $1,400 per token, but eventually dropped to just $80 each.

In the 2019 example, Ethereum rallied from $80 to $380. In 2020, it fell back to $90. Those who held through the downtrend would have watched all profits disappear and a year later end up where they started.

Granted, Ethereum had a strong 2020 and is even stronger at 2021, because it could turn around at any given time, trading is the better option and proves that buy and hold isn’t always safe. The more than 60% crash mid-2021 is all the evidence necessary.

Trading

Rather than holding through powerful downtrends, spot traders can sell their Ethereum for cash and prevent loss. But there’s no way to profit from these downtrends on a spot platform.

Traders who bought Ethereum at the 2020 low and sold at the high would have more than $4,000 in profit.

Derivatives trading lets traders profit from drawdowns, much like they can during uptrends. By opening a long or short position, traders can profit no matter which way the market turns.

In the derivatives example, using CFDs offered by advanced cryptocurrency trading platforms like Caltex Pro Minerss, the same $4,000 profit with leverage could have resulted in $400,000 earned instead. It is quite clear why relying on CFDs beats holding or spot trading any day in terms of total capital gained. Trading, however, comes with risks, so risk management strategies are a must.

Even more importantly, with CFDs, traders could have shorted Ethereum and made money off the crash from $4,400 to $1,800 also.

Pros And Cons of Ethereum

Ethereum is a highly volatile crypto asset and a polarizing technology. The market is continuously grooming what is claimed to be the next Ethereum killer, but no other project has ever been able to come close to Ethereum in terms of utility and usage.

Pros

- The hottest token in the crypto market currently due to DeFi and NFTs.

- Ethereum just broke its all-time high and is ready to soar higher.

- The smart contract platform could replace Wall Street’s back end.

- ETH 2.0 is rolling out.

Cons

- Ethereum has recently struggled with scaling due to how strong the demand for DeFi is.

- There is still a lot of Ethereum held by ICO treasuries that could dump their tokens.

- Tons of competitors exist, all vying to become the Ethereum killer.

- Fees have been rising and discouraging investors from transacting in the token.

How Much To Invest In Ethereum?

Ethereum is currently priced at roughly $2,000 per ETH. However, even just a fraction of Ethereum can be purchased starting on most exchanges or trading platforms at a very low minimum. This means there is no real floor in terms of Ethereum investing. However, it is wise never to invest more than you can comfortably afford to lose.

Is It Worth It To Invest In Ethereum?

Investing in Ethereum has just about always been worth it, except for those who bought the top of the bubble. Even then, if they hold on long enough, however, they will eventually be in profit. But they are an example as to why trading is the best method.

Is It Smart To Invest In Ethereum?

Ethereum investing is smart if you are careful with how much you invest, employ strict risk management strategies, and trade instead of hold, you can make a lot of money.

Is Ethereum A Good Investment?

Ethereum makes an excellent investment due both to its easy accessibility for retail traders and its long term growth potential.

How To Invest In Ethereum?

Ethereum makes an excellent investment due both to its easy accessibility for retail traders and its long term growth potential.

Is Day Trading Crypto Profitable?

Day trading crypto can be extremely profitable when utilizing CFDs, long and short positions, and leverage to amplify profits and earn from both directions the market heads.

Why Choose Crypto Over Traditional Investments?

Crypto assets are incredibly volatile, causing enormous price swings that enable massive profit opportunities in between.

What Is The Minimum To Invest In Ethereum?

There is no minimum to invest in Ethereum, but some platforms may require a minimum purchase. Caltex Pro Minerss requires only a 0.001 BTC deposit to get started.

Should I Invest In Ethereum Now?

If you are satisfied with this guide's research, you can get started investing in Ethereum now on Caltex Pro Minerss. You can also continue your research.

Where To Invest In Ethereum?

While there are several choices for Ethereum investing, the most lucrative option is Caltex Pro Minerss. The award-winning margin trading platform lets traders build a diverse portfolio, acting as a one-stop-shop for traders seeking exposure to crypto, forex, commodities, stock indices, and more. Registration takes just one minute or less and requires only a 0.001 BTC deposit to begin. There you can prepare a position in Ethereum and start investing in the cryptocurrency today.

Risk Disclaimer:

Investing in or trading gold or other metals can be risky and lead to a complete loss of capital. This guide should not be considered investment advice, and investing in gold CFDs is done at your own risk.

The information provided does not constitute, in any way, a solicitation or inducement to buy or sell cryptocurrencies, derivatives, foreign exchange products, CFDs, securities, and similar products. Comments and analysis reflect the views of different external and internal analysts at any given time and are subject to change at any time. Moreover, they can not constitute a commitment or guarantee on the part of Caltex Pro Minerss. The recipient acknowledges and agrees that by their very nature any investment in a financial instrument is of a random nature and therefore any such investment constitutes a risky investment for which the recipient is solely responsible. It is specified that the past performance of a financial product does not prejudge in any way their future performance. The foreign exchange market and derivatives such as CFDs (Contracts for Difference), Non-Deliverable Bitcoin Settled Products and Short-Term Bitcoin Settled Contracts involve a high degree of risk. They require a good level of financial knowledge and experience. Caltex Pro Minerss recommends the consultation of a financial professional who would have a perfect knowledge of the financial and patrimonial situation of the recipient of this message and would be able to verify that the financial products mentioned are adapted to the said situation and the financial objectives pursued.