The images of the stock market floor, with ticker tape rattling off the rising and falling stock price while men in suits scream ‘BUY’ and ‘SELL’, is now more confined to movies. The new age of trading has taken the activity online and has made online trading a way to make money for almost everyone.

There are also many different ways to make money online trading, and many different assets to trade; strategies to use, and ways to make money trading, but one of the most popular and profitable ways is Day Trading.

Day Trading, as the name outlines, involves trading a stock, share, commodity — or nowadays — cryptocurrency, within a single day and trying to make as much profit as possible over the market movement on that day. This is a very common practice when trading forex, on foriegn exchange markets, as the price is constantly fluctuating and is relatively volatile, meaning there are big enough swings during the day to profit on.

Day Traders require a bit of skill and knowledge, especially about their chosen market, and the basic strategies of Day Trading. Leveraging and short-term trading strategies — such as scalping, range trading, news-based trading — help traders make money within their markets as they capitalize on small price movements.

This all sounds quite straightforward and simple so people often ask is Day Trading profitable? And that question is a little complicated because to be a successful day trader takes a lot of skill, and some luck, and there are also times when it does fail. So, another question you need to ask is, why do day traders fail?

The Difficulties Of Making Money By Online Trading

Day Trading is essentially buying something at one price, during the trading day, and selling it later that day at a higher price. This is very simple in theory, but a lot more difficult in practice. To be a success at Day Trading requires you to master a number of different strategies, be very in tune with your chosen market, and to have some luck go your way.

More so, Day Traders will usually be quite-well educated as the practice involves knowledge of economics, maths, politics, and a number of other sectors to have a broad and holistic approach to trading. It also helps to be quite well funded to begin with because in the Day Trading Game, money makes money — or one can use leveraging, but more on that later.

We have explained what it takes to be a good Day Trader, but it is also important to outline what traps to avoid, and what difficulties Day Traders face in their day-to-day operations trying to be profitable.

Difficulty #1 — Greed And Fear

Day Trading is an incredibly sentimental activity and it plays on personal greed and fear. What this means is that because of the highs and lows of trading which feel like wins and losses in a gambling sense, traders can start to be influenced by their own sentiment rather than sticking to tried and tested methods and strategies.

For instance, if a trader starts getting onto a winning run and is making profitable trade after profitable trade, they might be more inclined to be a little risky when it comes to the next trade. This could mean a bigger trade, a tighter margin, bigger leverage, or some other move that is fueled by greed and deviates from the plan.

If a trader then takes action too soon, holds onto a profitable gain for too long, or doesn’t cut their losses in a losing trade because of greed, they may well lose, and lose big. If this happens, the effects can devastate a whole day’s worth of trading, or even worse.

More so, this is a sliding scale of greed and fear. If a trader is knocked back after being greedy, their mindset will become one that is more aligned with fearful trading. Fearful trading then leaves the trader in a space where they can easily miss out on potential gains and wins for fear of trading too hard.

Fearful traders can panic sell when news breaks and they have a mindset that it will derail their market; they can avoid risky trades that are only appearing risky because of this fearful mindset, and would otherwise be within their normal trading strategy.

Essentially, being human is one difficulty for Day Traders as they are not machines, or robots, and will be influenced by factors outside of normal market indicators.

Difficulty #2 — The Whims Of The Market

Another difficulty for traders is that the market is not mechanical or robotic either, it too is swayed by sentiment and can be affected by a myriad of different aspects that need to be considered. Because news and information are so vital around the way in which markets move, gauging the effect of news as it happens and planning accordingly is a skill that takes time to develop.

For some traders, big breaking news events can be opportunities for profit, but for others it can mean huge losses if the markets do not react in the prescribed manner. The difficulty of reading the market is in fact one of the reasons that so many traders make provisions for when they get this wrong — not if.

To better understand the whims of the market, one needs to consider that the market is a collective group of other speculative investors and traders. This means you are trying to predict what a group of thousands of people will do depending on different factors.

But, to make things even more difficult, the market and its whims can act counter intuitively to news and events because these same traders are also hedging their trades and bets, and are looking to protect these investments in certain situations. So, even in times of bad news, there is money to be made, but only if you know exactly what you are doing and how to read the market.

Difficulty #3 — Building A Solid Trading Strategy

Looking at the two difficulties presented above, it proves that trading is a highly speculative endeavour and requires a nuanced touch, and an understanding that comes with that. The way in which successful traders manage to control their own greed and fear, as well as the whims of the market, is through building a solid trading strategy — of course, having a strategy is only half of the battle.

Building a trading strategy is difficult, as it requires finding a method that works for the trader, as well as one that fits the market that they are operating in. It is also a multi-faceted thing as it requires the use of certain trading plans when the market is going one way, and then a change in-tact when the market reacts differently.

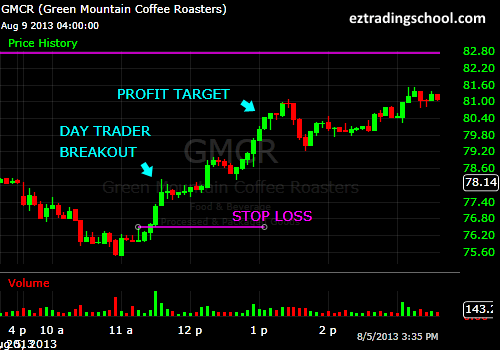

Day Trading is essentially predicting the future, thus looking at what happened in the past may give some indication, but that is not a strategy alone as the future is unpredictable. Trend following is one strategy that sees trades look for certain patterns that have come before, and then trying to react to them when they resurface, but then there is also the chance to counter-trend trade, which means betting against the trend and hoping to make gains in that way.

It is clear that building your robust and solid trading strategy is difficult, and takes some time to get perfected, and then one has to still be able to stick to it! Your strategy will have many different things thrown at it, like described above, fear and greed will play on your mind and force you to deviate from the plan. The market is also likely to do strange things that go against your strategy and force you off your path.

How To Really Make Money Trading

What the above is meant to show potential newbies wanting to enter into the Day Trading space in order to make huge profit with ease is that it is not as simple as you think, but, can you make money Day Trading — the answer is Yes!

Just like anything, Day Trading requires a bit of time and effort, but it also requires some know-how, and practice. But, once you have gotten going and start experiencing the market and how things work, and how to make money trading, you can start to become more and more profitable, and use more advanced tools, like margin trading and leveraging to really boost your potential earnings.

It will come as no surprise that the steps to making money with Day Trading begins with finding the right strategy for you — one that you can stick to. There are infinite different ways to build a strategy that uses different tools and techniques in different combinations, at different times. This is both a blessing and a curse as it makes getting a strategy hard, but allows for a lot of freedom in finding the right one.

From there, Day Trading is a lot about practice. Much like in sport, you can understand the game better than anyone, but you won’t be the best player on theory alone — you need to see how the ball bounces. It is the same with Day Trading. You can read about every possible way the market will react to certain events, but the market can always react differently to the same things, or there can always be new events that are unprecedented.

But, once you have the basics down — like strategy and experience — that is when you can start to make real money by using some of the most profitable tools out there: leveraging and margin trading.

Step 1 — Decide On A Strategy

It should by now be quite clear that strategy in day trading is vital. There are a number of different strategies to use that will promise either higher gains, or less work, and more manageable risk, but it is important for a trader to decide on what they want out of Day Trading first.

Traders also need to be well aware that this takes time, and it takes effort, as it is quite intensive throughout the day monitoring markets and price fluctuations, more so, it is risky as money can be made and it can be lost — this is why finding a strategy upfront that suits you is necessary.

When deciding on choosing a strategy, there are two paths you can go down. One involves using a fundamental strategy and analysing economic indicators as well as news that will support your predictions about a price move. This is a more rounded approach and takes into consideration a lot more than just the charts and general price movement. There is another way to do it though, which is called technical analysis.

Technical analysis involves monitoring how the charts are moving and reading the trend through the way the price rises and falls. There are patterns to be read and analysis to be made off them which can help traders predict the price movement, if this is their chosen strategy.

Choosing a strategy that involves technical analysis means you need to grow your understanding of chart movements but you also need to know which analytical tools to use and how they work. Terms like 200 Day Moving Average, Relative Strength Index, and Moving average convergence divergence, as well as many others, all come into play and need to be understood and implemented in a strategy.

Another important part of setting your Day Trading strategy is how you intend to manage your money, and your risk. Money Management involves traders trying to limit their risk on trades at times so that they have no more than 5 percent of their total account balance in the line of fire.. For example, if a trader has a balance of $10,000, they will want to not risk more than US$500.

Even when looking at this, traders can again hedge their risks by deciding to have 10 trades out at $50 each, or go a lot riskier and bet all $500 on one trade.

Step 2 — Practice With Simulation And Backtesting

Once you feel you have the right strategy, it is time to test it out and tweak where applicable. It is highly unlikely that in choosing a strategy with little to no experience that you will get it right straight away. That is why it is important to use trading simulators.

These simulators are ideal for new traders as they allow for a broad range of experimenting with absolutely zero risk. The funds are simulated and thus the trades can be as big and as brash as necessary in order to experience the true feeling of Day Trading and to feel what it is like to win big, and lose big as well.

Simulation trading is good for honing skills, however, it does mitigate the fear and greed aspect of trading somewhat as there is no risk of loss, or potential for gain, and only trading with real money can bring that aspect to the fire for traders.

Another way to get up to speed with Day Trading is to use “backtesting.” Backtesting is testing strategies with historical data to decide if your strategy would have been successful. This gives the trader the advantage of learning how certain scenarios sometimes play out in their market and if their decided upon strategy will lead to success should it happen again. Again, the risk is low here as it is more of a retrospective analysis of the past than a future trade on unpredictable outcomes.

Step 3 — Enhance Gains With Margin, Leverage

Once a trader has this basic grasp of trading, they feel their strategy is properly locked in, and their understanding is sufficient enough to deal with the whims of the market and their own fear and greed, then there is a chance to multiply profitability in trades.

As mentioned above, trading is risky business, but it is also profitable. There is a way which Day Traders can increase their profitability in multiples, but it does also raise the risk somewhat. Still, many of the most successful traders believe that using margin trading and leveraging is the key to greater success and bigger profitability.

Having a cash reserve is important when beginning to margin trade as this allows you to take that amount and multiply it by whatever the platform is offering. Margin trading essentially allows the trader to loan money from the platform in order to make their trade beefier and to increase the profits should the trade come good.

The amount at which this multiplication of gains comes in depends on the leverage that the platform offers. For instance leverage can range from a ratio of 2:1 to 400:1 to as much as 1,000x — such as Bitcoin-based margin trading platform Caltex Pro Minerss, which offers trades in a variety of assets.

Top Tip

The real defining tip that separates okay Day Traders from the real success stories that you read about in the media is definitely leveraging. This allows traders to use only a small amount of capital to trade large positions and thus profit much more than had they only used the capital they were willing to put up.

Because it works on a multiplier, it is essentially trading with a multiple of the capital you have, or are willing to put up, which means profits are multiplied by the leverage. Leverage is often talked about as a risky move — which it can be — but like with any part of Day Trading, it just requires good knowledge and understanding.

Another way to look at Leverage trading rather than as a risky or profitable strategy is to look at how it affects your trading capital. By leveraging, you can put up a small amount of capital and make the trade worth your while, and still have capital left over to make another trades with. This becomes a highly efficient way to make trades as you can spread your riskable income out.

In fact, there is an argument that Leverage can actually reduce risk in a certain viewpoint. For example, if a trader that was to invest in ten thousand shares of an individual stock at $10 per share would require $100,000 worth of capital, and that would mean that all of that $100,000 would be at risk.

But, if the trader wanted to make that same trade — with exactly the same potential profit or loss (which would be a tick value of $100 per 0.01 change in price) using highly leveraged markets, they would only need part of that $100,000, for example, $5,000. This means that only $5,000 is technically at risk.

Conclusion

People want to know how to make money trading because there are stories that it is easy through Day Trading. That is not entirely true. It is possible to make a lot of money Day trading, and it is possible to become really good at it, but it takes a bit of work to get going and to become highly successful.

Day trading is not mechanical and robotic, it needs a bit of gut feel and instinct. It needs experience too in order to know how to move and react in an ever changing arena. Day Trading is a very broad and encompassing way to make money, but it is a way that most people can start to make money.

Also, one of the biggest advantages of Day Trading is the potential for profit is exponential. Once you start getting good at the basics, it is possible to increase your profits by doing the same thing, but with better techniques and tools — such as margin and leverage trading.

If you would like to try and increase your profits as a trader already quite established — or even if you are a newbie trader looking to get into the game — it is worth checking out a free account from Caltex Pro Minerss which will offer you the chance to day trade on forex, commodities, cryptocurrency and some of the most popular indices such as S&P 500, FTSE100 with leverage of up to 1,000x. Sign up here.

Risk Disclaimer:

Investing in or trading gold or other metals can be risky and lead to a complete loss of capital. This guide should not be considered investment advice, and investing in gold CFDs is done at your own risk.

The information provided does not constitute, in any way, a solicitation or inducement to buy or sell cryptocurrencies, derivatives, foreign exchange products, CFDs, securities, and similar products. Comments and analysis reflect the views of different external and internal analysts at any given time and are subject to change at any time. Moreover, they can not constitute a commitment or guarantee on the part of Caltex Pro Minerss. The recipient acknowledges and agrees that by their very nature any investment in a financial instrument is of a random nature and therefore any such investment constitutes a risky investment for which the recipient is solely responsible. It is specified that the past performance of a financial product does not prejudge in any way their future performance. The foreign exchange market and derivatives such as CFDs (Contracts for Difference), Non-Deliverable Bitcoin Settled Products and Short-Term Bitcoin Settled Contracts involve a high degree of risk. They require a good level of financial knowledge and experience. Caltex Pro Minerss recommends the consultation of a financial professional who would have a perfect knowledge of the financial and patrimonial situation of the recipient of this message and would be able to verify that the financial products mentioned are adapted to the said situation and the financial objectives pursued.