In the world of investing Gold has been one of the longest-standing, and most popular assets over many years. It used to underpin currencies, it is valuable in electronics and is highly sought after in the world of jewellery, but more than any of this, its market has become a well established one that attracts investors who are mostly looking for a safe haven-type asset that is prone to steady growth.

However, Gold is under threat from a new asset that is only just 10 years old — Bitcoin. This new digital asset class of cryptocurrency has often been labelled as digital gold as the two entities share many similarities, despite being very different. Bitcoin’s market is breaking into the mainstream consciousness as a store of value, and as such, has been drawing attention from investors — but those who are a lot younger, and more digitally inclined.

However, the question still remains which of these assets is the better investment, and can make you more money, and should you buy gold or Bitcoin. Their similarities both make them good stores of value, but their vastly different markets, appearances, and uses have made these two assets divide opinion quite strongly.

On the one hand, gold has a proven value, multiple investing products like ETFs, futures markets and funds, as well as the added benefits of being uncorrelated and thus a good hedging asset. But, Bitcoin is known to offer much higher profits, and because of its entirely digital nature, it is global, inclusive, liquid and easily stored and moved around. Not to mention, Bitcoin has also shown its lack of correlation to other assets and Bitcoin is worth more than gold.

With all this to consider, it is still difficult to determine which asset is better for you. More so, it is pertinent to look at how to invest in each of these assets, as well as their major differences when it comes to trading each one, before making up your mind.

1 Bitcoin overtook the price of 1 ounce of Gold for the first time in March of 2017

Gold

Buying Physical Gold

Of course, because gold is a physical substance that is a mineral that is mined and refined, it is possible to buy it in its physical form. This can range from raw ore to processed nuggets, but for most, it will come in ingots, bars, or of course as gold jewellery. For serious investors in gold, there is bullion that can refer to gold bullion bars or gold bullion coins.

Bullion doesn’t have any artistic value, which makes it different from jewellery or numismatic coins. To buy gold bullion you have to pay a premium over the gold price which can be in a range from 3 to 10 percent. You will also have to use a vault or a bank deposit box to store it.

The pros of investing in gold like this are that you are in total control of your asset and can store and hold it where you please with no interference from third-parties like banks. However, this can also be seen as a con as the responsibility rests with you if it is stolen or lost.

Buying Gold Futures

Another way to invest in gold which allows you to bypass the issues of physically handing the gold is by buying gold futures contracts. Futures contracts are standardized contracts that trade on organized exchanges. They allow a holder to buy or sell an underlying at a specified time in future and at the price from the futures contract.

Essentially, this is making a contract on the predicted price of an asset, in this case, gold, predicting if it will go up or go down over a certain time period. Every day your position is going to be marked-to-market. This means that if the price goes in your direction, you’ll make a profit, but if it goes against you, you’ll lose money. If your account drops below the maintenance margin, you will have to transfer money to your account to meet the amount of initial margin.

The advantages of this are that you can leverage your position which allows you to put more money on your contract than you hold, and the settlement is usually in cash which is more liquid and easily accessible. However, this type of investment is also a lot riskier as your investment can come to nothing if the price moves against your contract.

Buying Bitcoin ETFs

Another institutional investment product that has come to the gold market is that of Gold ETF – exchange-traded funds. These funds allow you to again invest in gold but without ever letting your hands physically on the asset.

In short, Gold ETFs are units representing physical gold which may be in paper or dematerialised form. One Gold ETF unit is equal to 1 gram of gold and is backed by physical gold of very high purity. So when you invest in a gold ETF you are essentially investing in a digitized gold. Gold ETFs combine the flexibility of stock investment as you can trade and sell your ETFs easily on the market, and you also have the simplicity of gold investing and its well-understood market.

But, on the negative side, Gold ETFs require a high degree of trust that the ETF you are buying is backed by true assets and to this end, they subject to stringent regulation as well as regular audits.

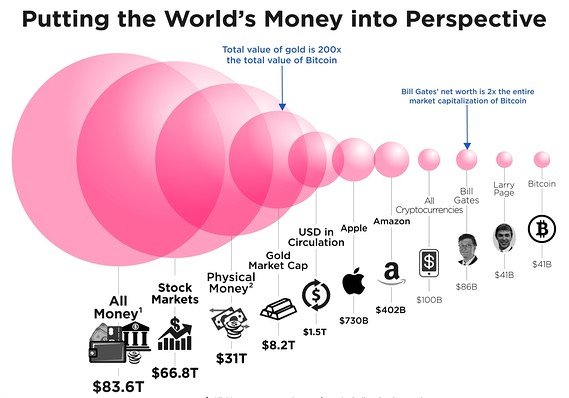

Gold’s market cap dwarfs that of Bitcoin – Note: Bitcoin’s current market cap today is four times larger than this graph suggests as it was made in June of 2017. Bitcoins market cap is up around $157 billion, which is still tiny compared to Gold’s 8.2 trillion.

Bitcoin

Buy and Hold

One of the most common, and easy, methods to invest in Bitcoin is simply to buy and hold the digital asset. Because it is entirely digital, anyone can buy the currency from their smartphone and some sort of exchange app.

Buying Bitcoin requires a wallet, and there are various types of wallets that allow for different methods of transfer and storage; from cold wallets, to exchange wallets, to decentralized wallets. Each of these has its advantages and disadvantages.

For the most basic of Bitcoin buyer, an exchange wallet is probably the easiest way to invest in bitcoin as it allows you to be attached to the market and makes the asset incredibly liquid. However, this does not offer you your private keys which essentially means the exchange is in custody of your coins and if something goes wrong with them, you can lose everything.

There are wallets where you are in control of your private keys. These allow you to have full custody and control over your Bitcoins. However, the negative aspect of this is that it makes it much harder to sell your coins for fiat.

Finally, you can buy Bitcoin and store it offline in what is known as a cold wallet. One of the more secure ways to invest in Bitcoin as it allows you to keep your coins away from online dangers as they appreciate.

Online Trading

Online trading is probably the most profitable way to invest in Bitcoin and is comparable to buying and selling stocks. Because Bitcoin’s price is well known to be quite volatile, it makes it an attractive asset to trade and can offer large profits for good traders.

Online trading calls for buying Bitcoin and monitoring its price-determining when to sell, and when to buy more in order to sell again at a higher price. Online trading is such a profitable way to make money investing in Bitcoin because the price of the coin has been known to grow as much as 40 percent in a single day in recent times. Online trading allows users to quickly buy, and sell, the asset with ease, and often too big profits in a short space of time.

But of course, one big question that comes from this form of investment is: ‘is Bitcoin a safe investment?’ As the Bitcoin market has matured, and more institutional investment opportunities have come up, it appears as if the cryptocurrency has moved beyond being an unregulated and purely speculative investment.

Bitcoin Futures

Bitcoin futures are a new asset that is increasingly growing in popularity as more and more traders realize that the Bitcoin market is an exciting and fast-paced one. Again, like gold futures, this investing method requires a user to bet on the direction that the price of Bitcoin is going to go.

These contracts can either be short, which means the prediction is that the price is going down, or they can be long, which indicates a prediction of a rising price. Bitcoin futures have seen more traditional investors enter the market as they are used to the product, and while this is an advantage, Bitcoin futures are also a risky way to invest as the volatile market can lead to big losses if the predictions go wrong.

Mining

Bitcoin Mining is a very different way to invest in Bitcoin as it is a passive method. This involved purchasing, often expensive, hardware that is used to try and unlock new blocks in the Bitcoin blockchain. The reason for this is that with each new block unlocked, the blockchain offers 12.5 BTC as a reward – currently.

The advantage of this form of Bitcoin investing is that, if the profit margins are managed well, it can be an ongoing passive income. However, the negative is that it requires a bit more technical know-how and the profitability is subject to the price in the market as well as the cost of local electricity.

Bitcoin vs Gold – Top Differences Between Bitcoin And Gold For Traders

Volatility

One of the biggest differences between cryptocurrency vs gold as an investable asset is their volatility. Gold has gained a reputation as being a slow and steady asset for investment and thus is known to be a good store of value as its price movements are gradual and gentle. On the other hand, the volatility of Bitcoin is one of its most well-known factors when it comes to investing in the asset.

The reason its volatility is so well known, and actually very prized, is that it offers the opportunity for a strategy of short selling with an asset that has high volatility; this is known as a straddle or a strangle.

In a straddle, the trader writes or sells a call and put at the same strike price in order to receive the premiums on both the short call and short put positions. The rationale for this strategy is that the trader expects Implied Volatility to abate significantly by option expiry, allowing most if not all of the premium received on the short put and short call positions to be retained.

In 2017 Bitcoin’s volatility was demonstrated to have an exciting effect, rising from $1,151 to $19,783 between January and December. It then plunged to $5,951 by February 2018, before rallying again to $11,537 over a matter of days, with more dramatic spikes to come over the year.

Gold’s price has seen a much less volatile journey in recent years; since 2013 the price has held fairly consistently at around $1,225 ranging between $1050 and $1400 (as of November 2018). Indeed, in 2017, there wasn’t a single trading day during the year when gold ended more than 2.5% higher or lower than it had ended the previous day, an occurrence that hadn’t been seen since 1996.

Storage Procedure

Of course, another big difference between gold, and what is known as digital gold, is how it is stored. As implied in Bitcoin’s moniker, it is entirely digital and thus there is no possibility of it ever being tangible. This differs totally from gold which is tangible, despite it being possible to invest in it digitally.

As a physical asset, gold is stored in vaults, safety deposit boxes in banks and personal safes for smaller amounts. Bitcoin, on the other hand, cannot be stored in the traditional sense.

Instead, what is stored is a secret number called a ‘private key’, which facilitates the transfer of Bitcoin from one party to another. Buying Bitcoin can be risky if you do not make use of a hardware or software wallet to secure your private key.

But at the same time, Gold can be equally risky as its existence in the physical realm opens it up to be stolen too, if not properly stored or hidden.

Sources of Demand

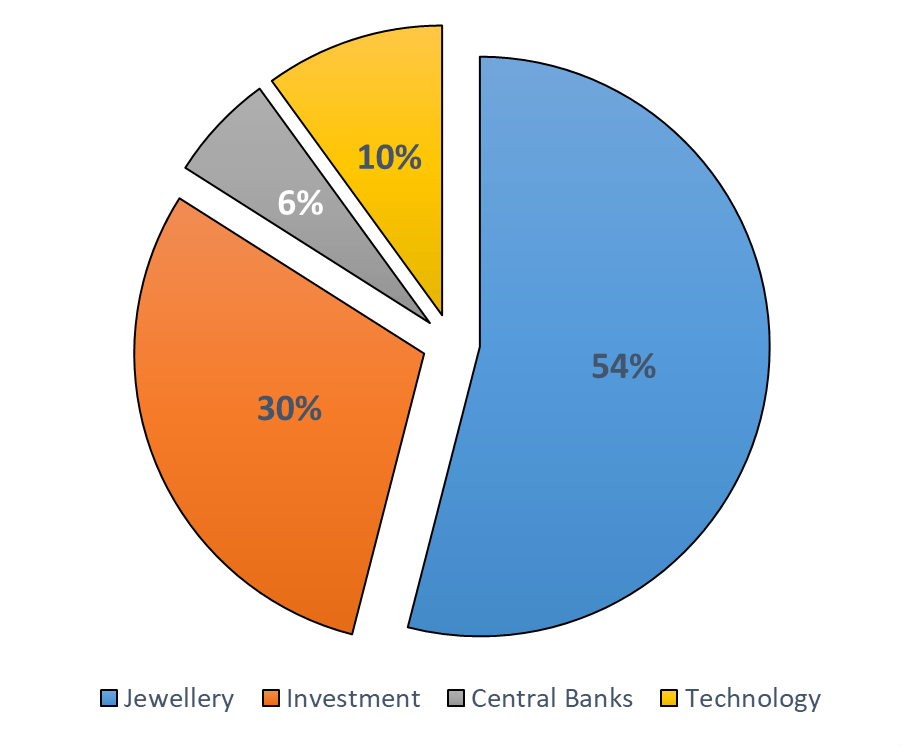

Because gold has a history that stretches back more than 700 years, it has become ingrained in a number of areas of society and thus the sources for its demand are easily identifiable over four main sectors. These include Jewelry – which is the largest, then as an investment toll, next is its use in technology, mainly as a conductor, and finally, central banks also covet it as an investment and hedge.

Bitcoin, on the other hand, has not been around as long and its designation — either as a currency or as an asset — is still up for debate. Because of this, its sources of demand are far less well defined.

Currently, Bitcoin’s learning is more towards being a store of value rather than a currency, which was its original intention. Because of this, it’s demand comes mostly from investors who are looking to hold onto it for its ability to appreciate — much like gold investors.

Sources of demand for Gold.

Utility as a Currency

While Bitcoin was designed to be a currency and has shifted towards being an investable asset and more of a digital gold, it can be argued that gold has done the reverse. There was a time when gold was used as a medium of exchange in the form of minted gold coins, but that has changed it would be hard to determine gold to be a currency today.

However, Bitcoin still retains its ability to be a currency, even if it is not primarily used for that reason. In order to be money, it is determined that a thing needs three aspects; medium of exchange, unit of account and store of value.

Again, both gold and Bitcoin probably can tick all three boxes, but the manner in which gold has evolved over time has made it far less of a medium of exchange, especially in consideration to Bitcoin.

What To Remember When Investing In Bitcoin Or Gold

| Gold | Bitcoin | ||

| Advantages | Considerations | Advantages | Considerations |

| Years of proven worth | Physical asset requires physical access | Larger profitability options, like trading | Volatile market |

| Range of ETFs and Investment tools | Storage and transport expenses | Digital, global, accessible, liquid | Regulatory concerns for ETFs |

| Safe Haven asset | Low profitability | Little correlation with other assets | Unproven value and worth |

Conclusion

These two assets are so independent of each other, but at the same time have a high level of interdependence. Gold is one of the oldest investable assets around and has had a long and storied history which has set its market up to be predictable, comfortable and reliable.

For many investors, especially those who are of the older generation, this suits just fine. Gold does what it does without much concern, and it fits into the portfolios of many investors with its lack of correlation and steady profits. However, the digital revolution and the digital generation coming to the investing age are not that enamoured with gold.

This is where Bitcoin, being similar to gold in many respects, and called digital gold, has some attractiveness for investors, but Bitcoin offers a lot more for the on-the-go generation. Being digital, easily accessible, volatile and exciting makes Bitcoin the new generation gold.

More so, the growing online trading space for Bitcoin has even seen it permeate into the traditional investment space as the metaphorical Wall Street types appreciate how much profit can be made from investing, and especially trading, in Bitcoin

Risk Disclaimer:

Investing in or trading gold or other metals can be risky and lead to a complete loss of capital. This guide should not be considered investment advice, and investing in gold CFDs is done at your own risk.

The information provided does not constitute, in any way, a solicitation or inducement to buy or sell cryptocurrencies, derivatives, foreign exchange products, CFDs, securities, and similar products. Comments and analysis reflect the views of different external and internal analysts at any given time and are subject to change at any time. Moreover, they can not constitute a commitment or guarantee on the part of caltexprominers. The recipient acknowledges and agrees that by their very nature any investment in a financial instrument is of a random nature and therefore any such investment constitutes a risky investment for which the recipient is solely responsible. It is specified that the past performance of a financial product does not prejudge in any way their future performance. The foreign exchange market and derivatives such as CFDs (Contracts for Difference), Non-Deliverable Bitcoin Settled Products and Short-Term Bitcoin Settled Contracts involve a high degree of risk. They require a good level of financial knowledge and experience. caltexprominers recommends the consultation of a financial professional who would have a perfect knowledge of the financial and patrimonial situation of the recipient of this message and would be able to verify that the financial products mentioned are adapted to the said situation and the financial objectives pursued.