Last week was all about the major collapse across the cryptocurrency market that caused Bitcoin to plummet to under $4,000 in the most volatile move in years.

This week, however, was focused on the recovery.

Bitcoin and the rest of the cryptocurrency market finally showed signs it is decoupling from the stock market mayhem, and could finally be on its way toward a longer-term recovery heading into Bitcoin’s halving this May.

However, with the coronavirus acting as a black swan event with so many unknowns, this latest recovery could simply be a strong bounce before the panic-induced selloff continues and another wave of selling begins.

Bitcoin Shows Sharp Recovery After Record-Breaking Drop Last Week

Bitcoin price has grown by over 85% since the massive crash occurred that took the asset’s price to levels not seen in nearly two years.

The leading cryptocurrency by market cap started off the week trading in the low $5,000 range but has since pushed through resistance and hit a local high of $7,100 before a pullback occurred.

The rejection may have confirmed prior support as resistance, which would be an extremely bearish sign. However, a breakthrough of this level would likely cause FOMO buying, as investors would be convinced a bottom is in and Bitcoin’s price would go on to trend higher and higher with the asset’s halving scheduled for just two months from now.

Each halving reduces the supply of Bitcoin awarded to miners, thus lowering the supply sold into the market. This allows demand to overtake available supply, and the price of the asset to rise.

Bitcoin was tracking along perfectly for such price action, but the latest drop was so significant, it could have taken the wind out of the halving’s sails.

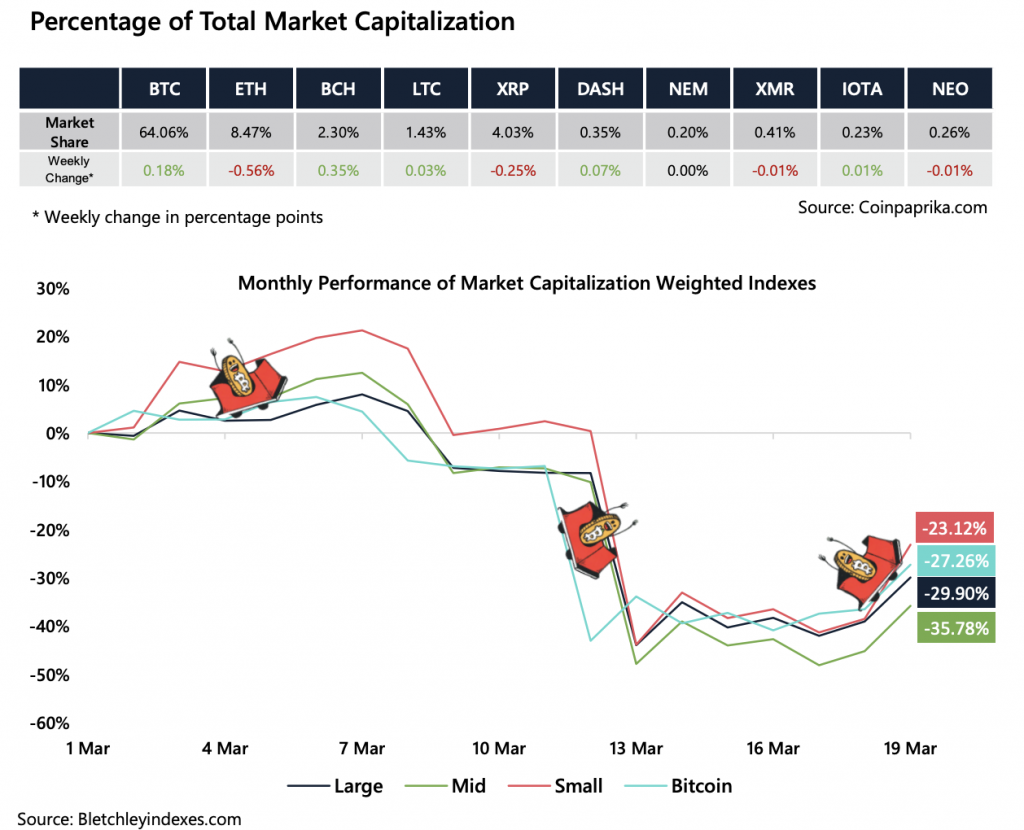

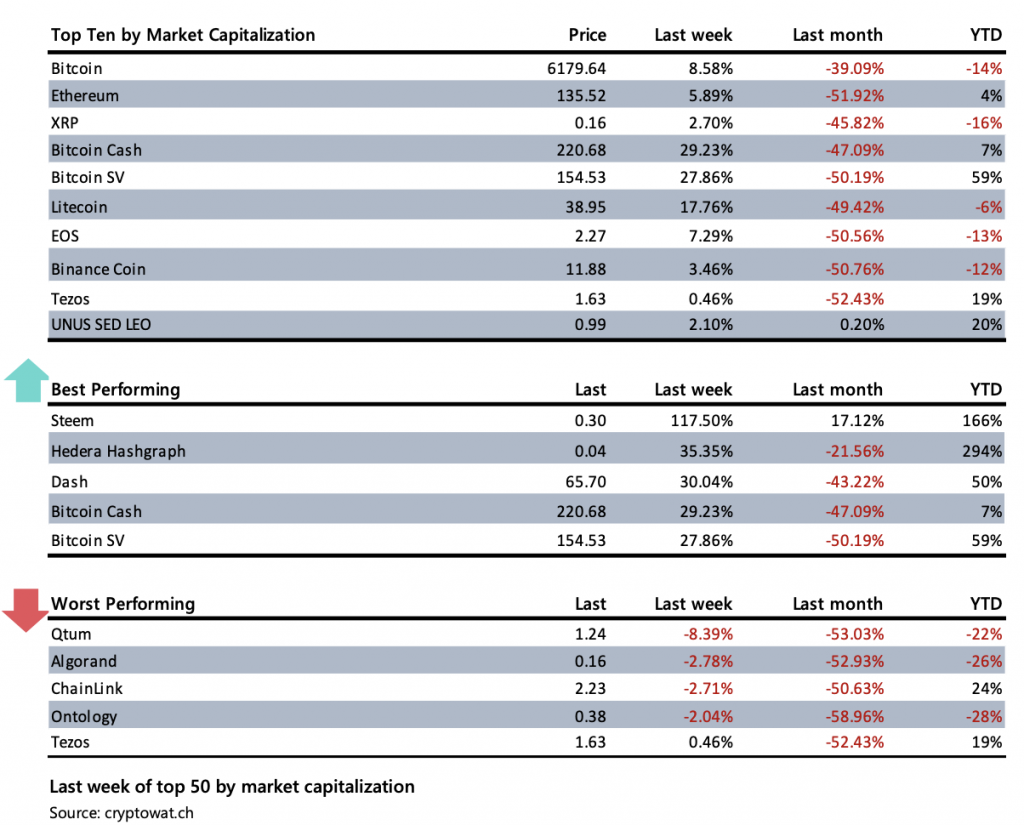

Small-Cap Altcoins Lead Crypto Market Recovery, But Investors Still Fearful

Although Bitcoin saw over 85% growth during the last week, it was small-cap altcoins that showed the most recovery across the cryptocurrency market.

Bitcoin outperformed large-cap altcoins like Ethereum and XRP, while mid-caps trailed in last place.

Bitcoin forks Bitcoin Cash and Bitcoin SV were the week’s top performers, alongside the Steem cryptocurrency, while past top performers Tezos and Chainlink saw the worst losses during the drop, likely due to extremely overbought conditions heading into the epic selloff.

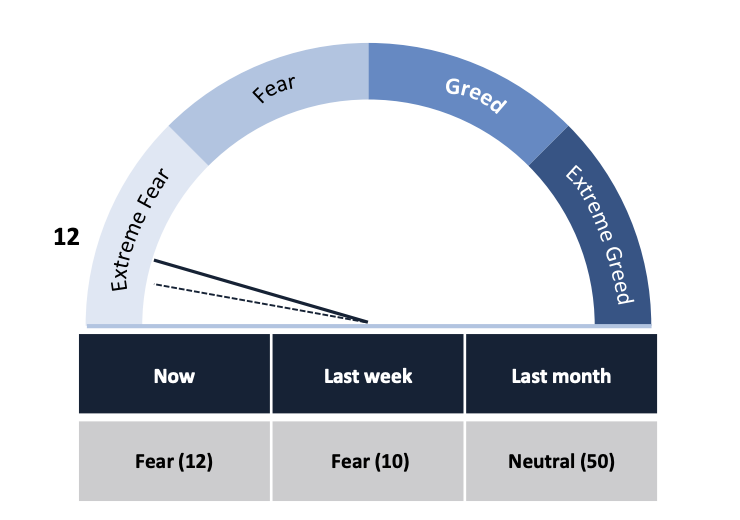

Despite the strong recovery across the board in all crypto assets, investor sentiment is still at extreme lows – as low as when the initial drop first happened. This suggests that either due to the pandemic, investors are simply spooked, or they just aren’t confident that this latest Bitcoin rally has legs.

Whatever the case may be, the market is still very fearful.

Volume and Volatility Soar As Bitcoin Decouples From the Stock Market

The selloff did have a positive side, even with prices collapsing to extreme lows.

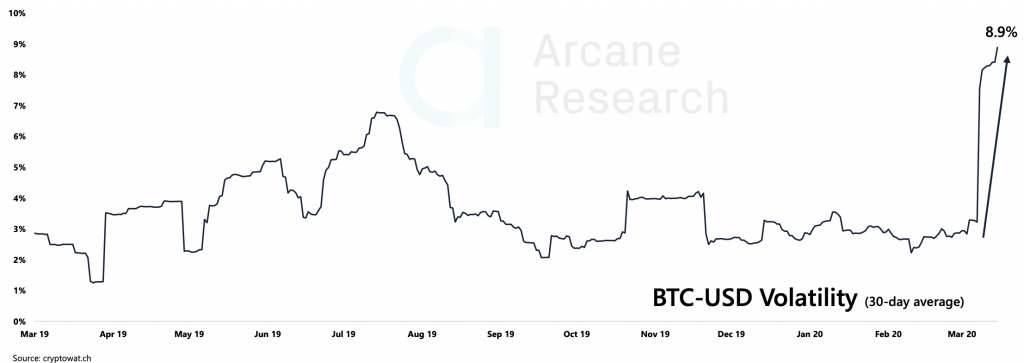

The lull in volatility has been broken, causing Bitcoin to reach the highest 30-day average for volatility over the last year.

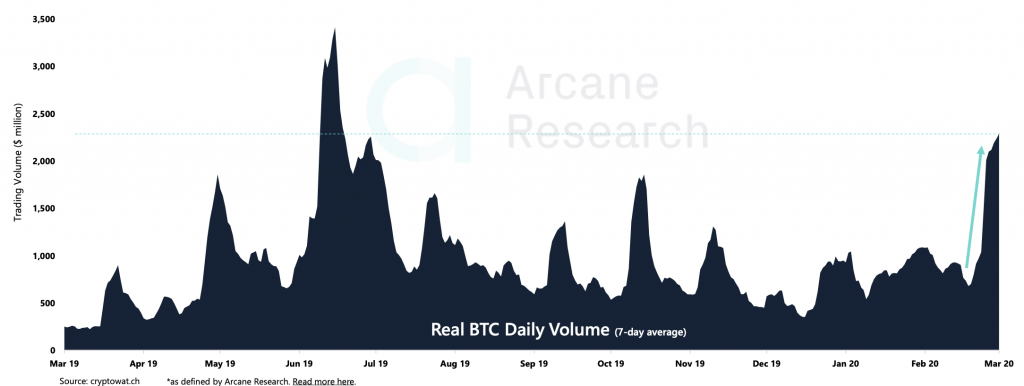

The explosion in volatility and assets changing hands, set a record for the highest level of Bitcoin trading volume since Bitcoin reached $14,000 in June 2019.

The breakdown in price action was enough to cause those who bought above to sell at a loss and dropped the price low enough for new investors to take interest.

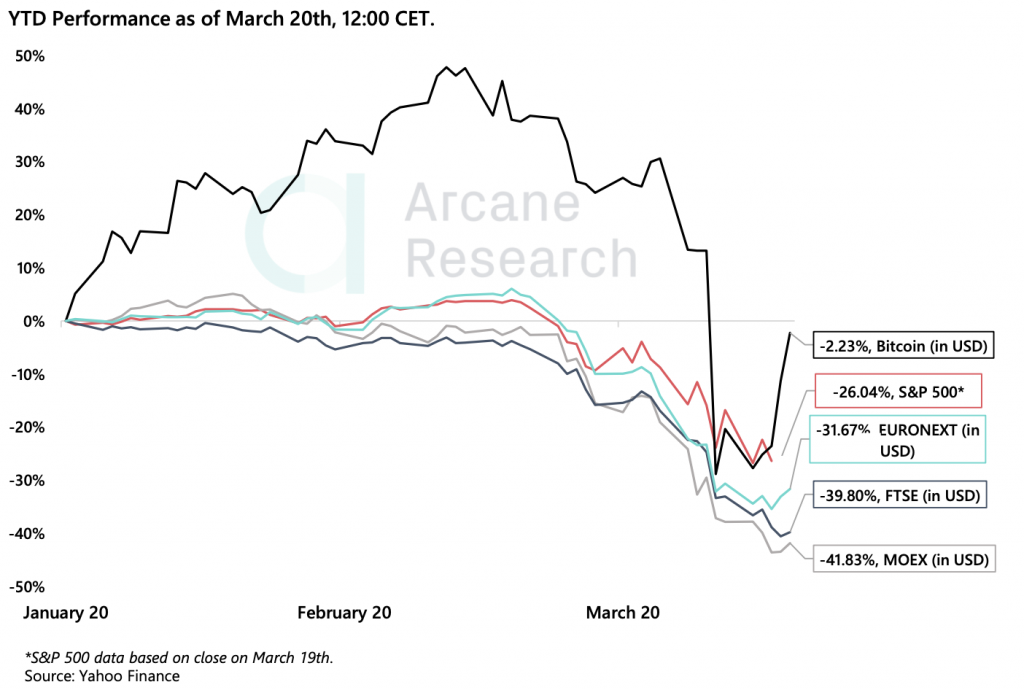

It also was enough to finally cause Bitcoin to decouple from the stock market. For some time, Bitcoin had been showing nearly 1:1 correlation with the S&P 500, but after the historic collapse, the correlation is beginning to unwind.

The stock market is ending its secular bull market, meanwhile, Bitcoin and crypto is just coming out of a bear market. The parity is likely to end completely once the coronavirus settles down.

HODLers Are Buying Up Bitcoin As Forex Currencies Flounder

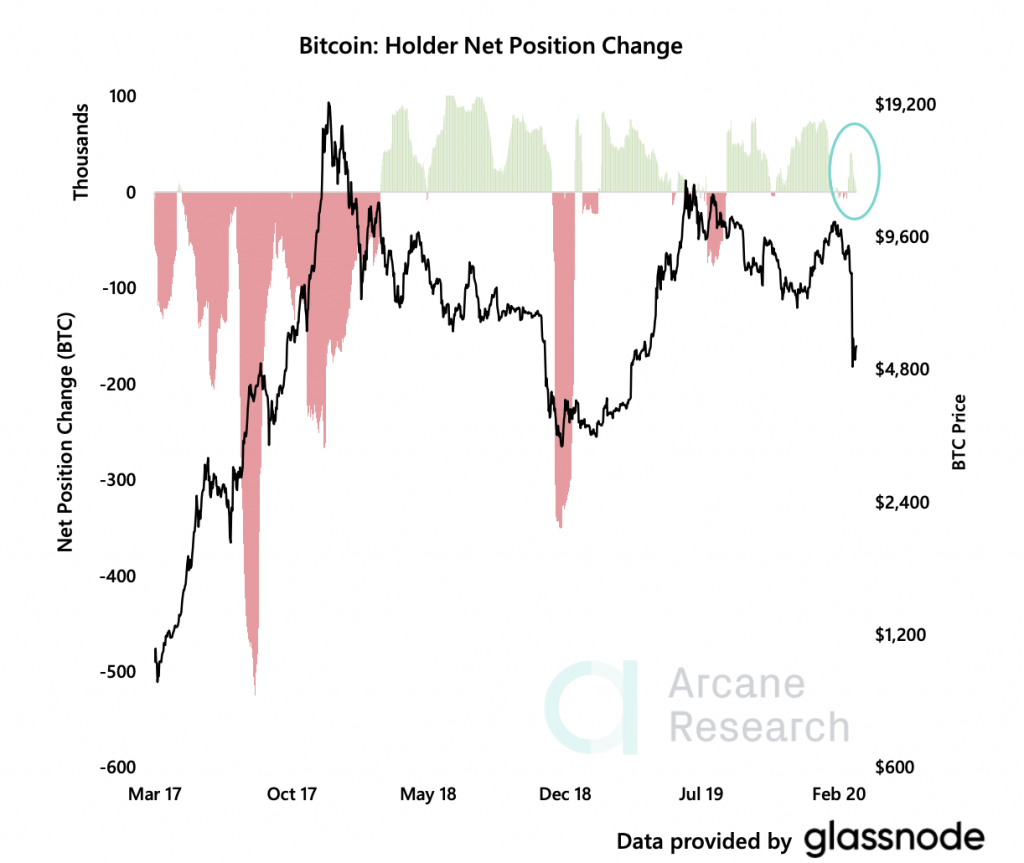

Even those who already hold Bitcoin may be buying that current prices.

According to blockchain data, long-term Bitcoin holders are not only not selling their holdings during the panic-induced selloff, but they’re actually buying up more Bitcoin at the lows.

Bitcoin is in full accumulation mode, according to Glassnode data.

The increase in long-term holders buying up more Bitcoin could be due to the upcoming halving, however, it could also be as a hedge against the possible collapse of fiat currencies.

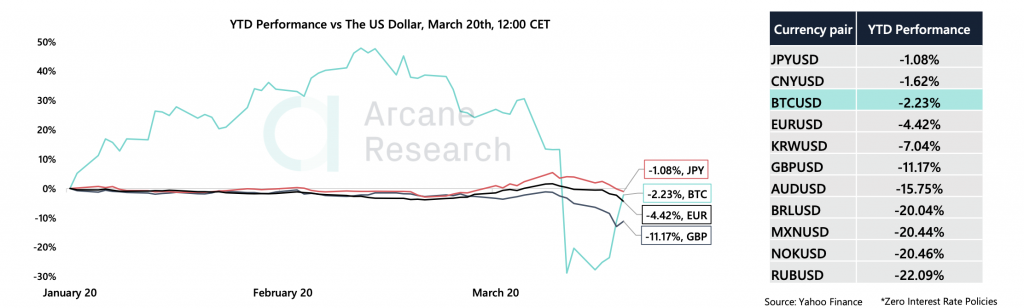

All across the forex market, currencies have begun to collapse against the dollar – the global reserve currency. Government overspending is causing investors to ditch other country’s currencies in favor of the dollar.

By comparison, BTC has held up well against the dollar.

But the best possible hedge even against the dollar is Bitcoin. While fiat currencies can be printed at the whim of central banks, and even the most helpful and necessary stimulus packages causing massive inflation, Bitcoin is hard-capped at just 21 million BTC.

The deflationary design could end up causing Bitcoin’s value to skyrocket while fiat currencies and the dollar fall from their pedestal.

This Week’s Biggest News Stories

Popular Web Browser Enables Crypto Purchases Via Apple Pay

Opera, the popular web browser, has enabled a feature that allows users to purchase cryptocurrencies direct from the browser using contactless payment options like Apple Pay.

World Health Organization Promotes Contactless Payments During Outbreak

Contactless payments like Bitcoin and Apple Pay could soon become the future of money, as even the World Health Organization is warning that cash could be a carrier for the coronavirus and to instead rely on other methods for payments.

Former Bitcoin Exchange CEO Accused of Insider Trading

Former CEO of the Bakkt Bitcoin trading desk, Kelly Loeffler, has been accused of insider trading after it was learned she dumped millions in stocks shortly after a closed-door meeting about the coronavirus was held.

Risk Disclaimer:

Investing in or trading gold or other metals can be risky and lead to a complete loss of capital. This guide should not be considered investment advice, and investing in gold CFDs is done at your own risk.

The information provided does not constitute, in any way, a solicitation or inducement to buy or sell cryptocurrencies, derivatives, foreign exchange products, CFDs, securities, and similar products. Comments and analysis reflect the views of different external and internal analysts at any given time and are subject to change at any time. Moreover, they can not constitute a commitment or guarantee on the part of PrimeXBT. The recipient acknowledges and agrees that by their very nature any investment in a financial instrument is of a random nature and therefore any such investment constitutes a risky investment for which the recipient is solely responsible. It is specified that the past performance of a financial product does not prejudge in any way their future performance. The foreign exchange market and derivatives such as CFDs (Contracts for Difference), Non-Deliverable Bitcoin Settled Products and Short-Term Bitcoin Settled Contracts involve a high degree of risk. They require a good level of financial knowledge and experience. PrimeXBT recommends the consultation of a financial professional who would have a perfect knowledge of the financial and patrimonial situation of the recipient of this message and would be able to verify that the financial products mentioned are adapted to the said situation and the financial objectives pursued.