This week has not been so much about Bitcoin as it has been about the altcoin market, and Ethereum in particular. The world’s second-largest cryptocurrency by market cap is posting good gains this week as progress continues to be made towards its major upgrade.

In fact, the whole of May was a good one for altcoins with the smaller capped coins coming out on top last month by a substantial margin in regards to gains. This even saw Bitocin and the other large capped altcoins languishing with modest gains over the month.

However, the market has once again turned greedy having popped above neutral on the Fear and Greed Index a few times in the last month or so. The wonder is whether this greed will stick around and build along with the price of Bitcoin which is still under $10,000.

Volatility, as well as volume, are on the rise again this week for Bitcoin, as the coin has shown perhaps a new upward trend in trading volume, but has posted another ‘bart pattern’ in regards to market volatility.

Concerns surround one so-called altcoin — Tether — that is now ranked the third biggest coin by market cap as people worry about the controversies at Bitfinex and Tether in the courtrooms. Meanwhile, the notion of its backing still remains shaky, and could cause a systematic risk to the entire crypto space.

It has also almost been a month since the Bitocin halving and while it looks as if it has not affected the price action of the coin too much, there is evidence that the miners are offloading theur Bitcoin holdings following the major event.

Still, the news is mostly good for Bitcoin and, even though it did not break its year-high after reaching resistance there over the $10,000 mark, the general projection of the coin is still seemingly upwards following the March market collapse.

Ethereum Taking Off

Ethereum is getting closer and closer to its much anticipated upgrade which will see its algorithm change from proof-of-work to proof-of-stake. This has not only the developers excited, but the investors too.

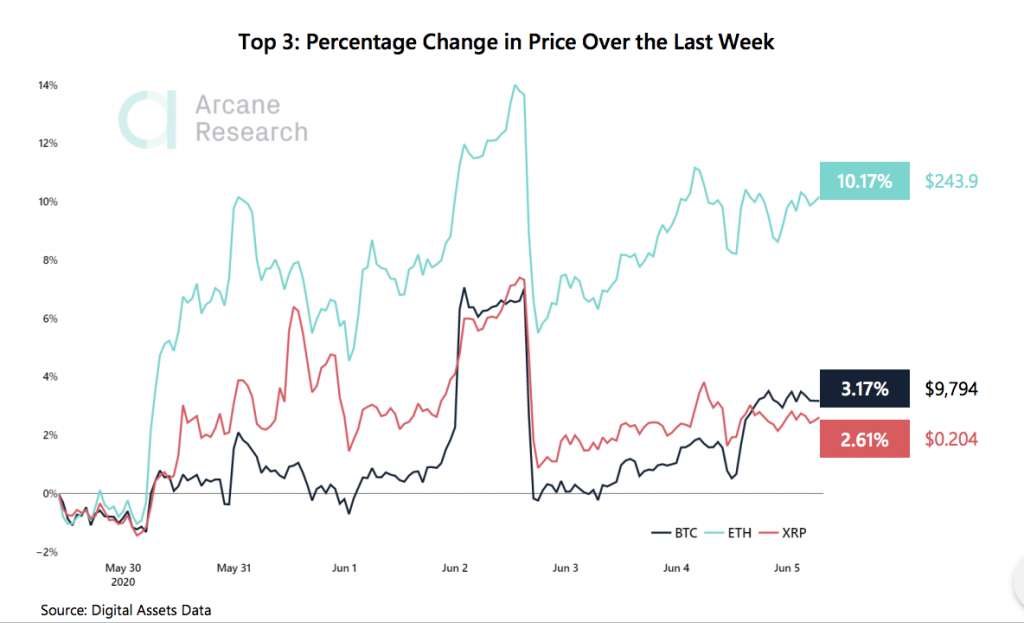

This is the third week in a row where Ehteteum has performed especially well and has in fact managed to post a weekly gain of over 10 percent. Its growth through the week has been exaggerated, but it was also then struck heavily by a bout of mid-week volatility.

Ethereum has outdone both XRP and Bitcoin, both coins only able to post gains of around three percent having also been struck by the volatility that created a classic ‘Bart pattern.’

However, despite the excitement about the upcoming Ethereum upgrade, the second-largest coin was not the best performer as Caradano, also fresh off some recent upgrades, posted an increase of over 35 percent, and was also followed by Zilliqa.

At the bottom of the pile though, Maker fell by over 10 percent and so did the high-flying Theta Token and Icon, which both lost over 8 percent.

Leverage Trading Causing Price Deviation

Part of the week’s price action across the whole cryptocurrency space involves the ‘Bart pattern’ that showed a steep rise, a bit of parallel trading, and then a steep drop. However, the damage from the drop, although not massive for investors, was made worse by excessive liquidations.

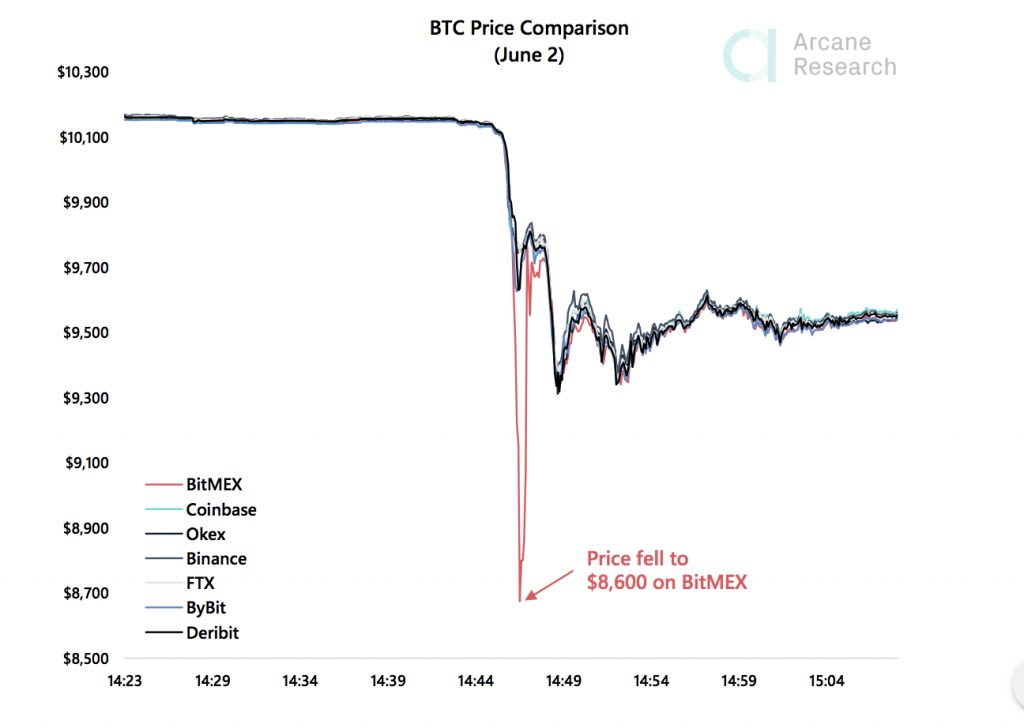

Major liquidations and an abnormal price deviation on BitMEX occurred this week when, while most other perpetuals fell to around $9,600- $9,700, the price on BitMEX bottomed out at $8,600. A spread of over 10% for almost half a minute.

This appears odd as BitMEX is supposed to be very liquid, but it is mostly a result of overextended leverage which caused a large number of positions to get automatically sold when the price drops substantially.

That means the sell orders all the way down at $8,600 got filled along the way and resulted in the $1,000 deviation on BitMEX compared to other exchanges. This equates to a whopping $100 million worth of Bitcoin being sold in this liquidation spiral.

Small Caps Take The Lead

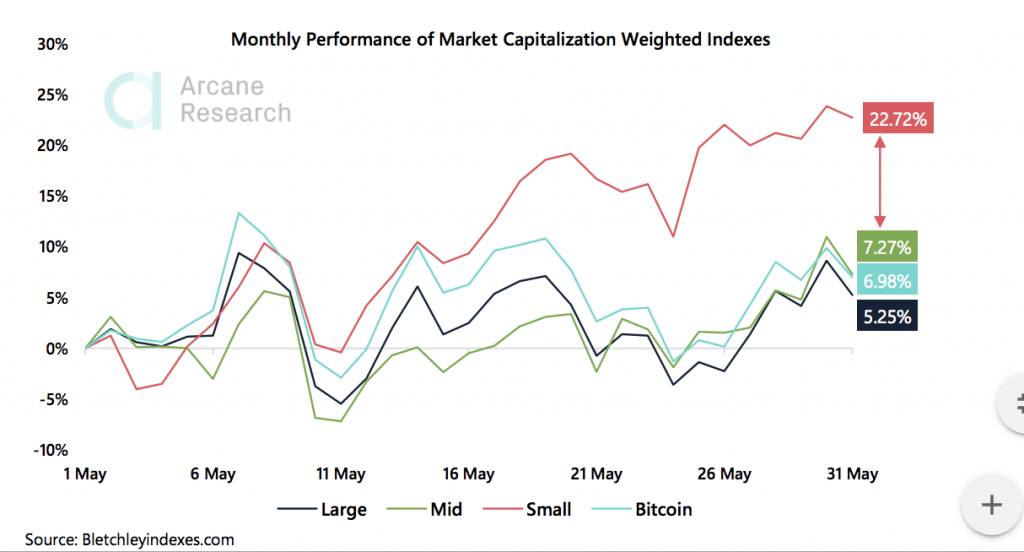

The last few weeks may have been about a well performing Ethereum, but the whole month has been a good one for the smaller capped altcoins which have managed to top the monthly performance grade of market cap weighted indices.

The small capped coins finished the month with gains aggregating to 23 percent with the next best index being the medium capped coins that only managed a seven percent gain. Bitcoin was just under that with six percent gains for the month and the larger capped altcoins came in with five percent.

A lot of the good performance from the smaller caps comes down to a few outliers such as OMG Network (formerly OmiseGo) that was listed on Coinbase recently, and Theta Network that just announced Google Cloud as an enterprise validator for the blockchain.

These two coins nearly doubled their market value in May and were a big force pushing small capped coins up so high.

Greed Is Back, But For How Long?

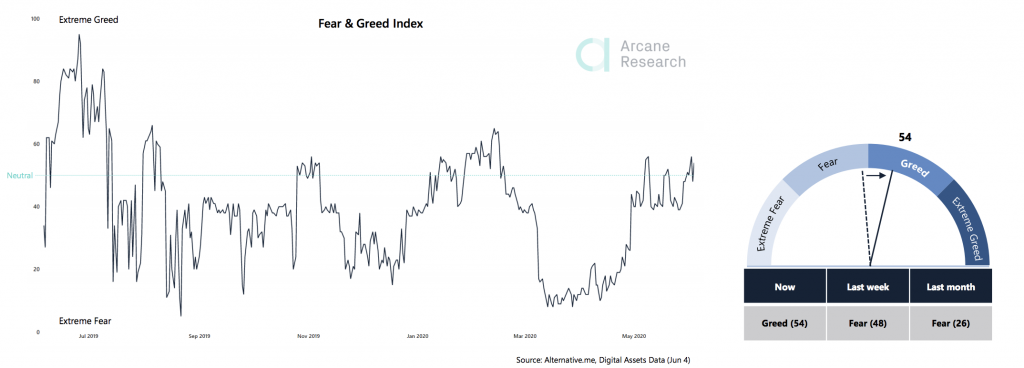

The market has been flirting with getting a little more greedy in the past month, managing to tip the Fear and Greed scale a few times, but only briefly in the last couple of weeks. It is now back into Greed having ranged between neutral and greedy.

It is looking for the sentiment to stabilize above the fear area, in order for the sign to be of more optimism in the market. Looking at the last year, the sentiment has not been great, as it usually is in the fear side of things for longer. Periods of greed have been short-lived, but they are worth watching to get away from mostly neutral.

Is Volume Back On The Rise?

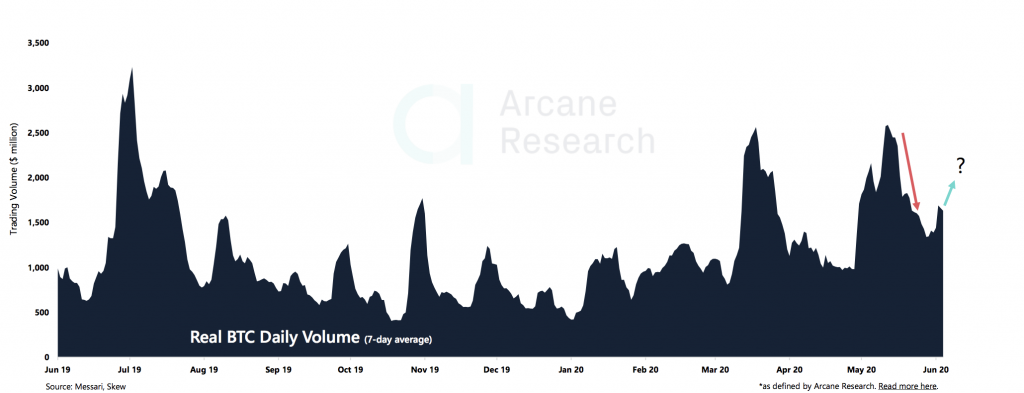

The past month has been highlighted by a continually falling trading volume chart which has seen the spike at the beginning of May almost whipped out. But, there looks like a change in the air might be upon the trading volume market as a new upward spike is growing.

The 7-day average real trading volume has seen the spike growing upwards as Bitcoin once again peaked above $10,000, even though it was short lived. If the volume can return, it may be a catalyst to turn the downward price trend around and perhaps push the coin above its year high.

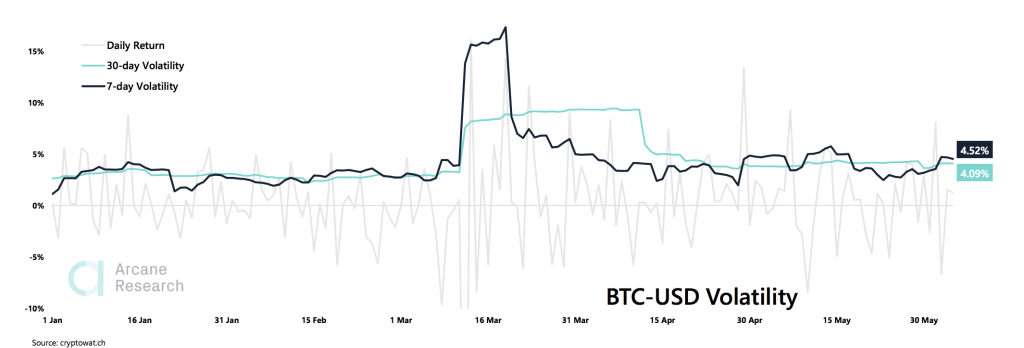

Volatility Posts ‘Bart’ As Month Comes To An End

The end of the month always brings with it fresh volatility and the Bitcoin market in general has been rather volatile of late anyway. But, with a big amount of derivatives contracts expiring at the start of this week, the new month has also not been that quiet. In fact, the charts showed us that classic ‘Bart pattern’ of a spike up, sideways trading, and a similar fall back down — all in a few days. The 7-day volatility is now above the 30-day volatility again, indicating increasing volatility lately.

Bitcoin Yet To Make A New Year High

The last movement upwards from Bitcoin which saw it again cross the $10,000 mark looked promising for those investors hoping for a new year high. However, it was not to be as that level of above $10,400 seems to have strong resistance.

However, even though Bitocin is not breaking new ground for the year, the general feeling is the price action is quite healthy, also considering that the support level of $9,500 was also maintained and strong.

However, there are a few ways the coin can go looking to next week, if it was to lose the $9,200 level the price could plummet as low as $8,000. But, for the more bullish investors, eyes will still certainly be on a close around the year high of just under $10,500 as that will spell a big leap forward.

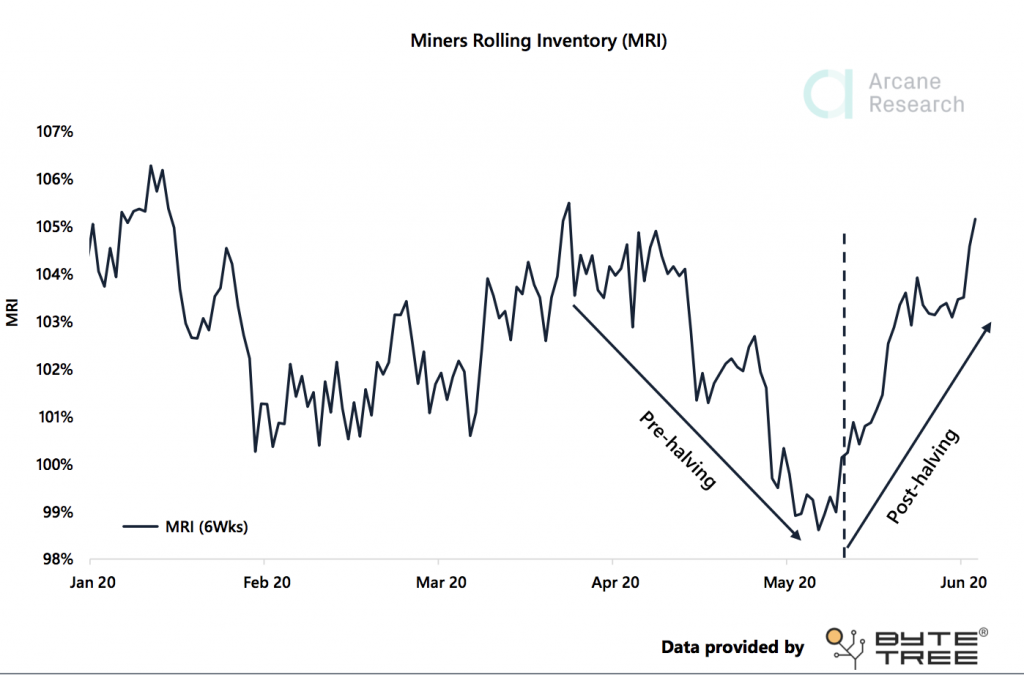

The halving is now sitting in the rearview mirror and it is mostly the miners that are dealing with it as there has been little impact on the price of the coin that can be directly attributed.

Data provided by Bytetree has indicated that the miners are offloading their Bitcoin holdings following the halving. Looking at the miner’s rolling inventory (MRI), which tracks the difference between what miners generate and what they move, there is a clear pattern.

An MRI less than 100% means that inventories are growing, since miners are moving less than they mine, but, a MRI above 100% means that miners are moving more than they are mining. The only way to do this is by also moving inventory built up previously.

Looking at the graph below, it is clear that the halving has forced the miners to sell their holdings. And, One reason miners could be selling off their inventories is, since halving, there is an extra need to cover the loss in revenue from the rewards.

In The News

Bloomberg Eyes New ATH For Bitcoin This Year

Research from Bloomberg has suggested that this year could see a new all time high for Bitocin and it could post over $20,000 a coin due to a number of external factors such as money printing and the Covid-19 pandemic impact on the market.

Bittrex And Poloniex Also Instigated In Market Manipulation Case With Tether

It is not only Tether that is at the heart of the case about the Bitcoin market manipulation as now two more exchanges have been added to the defendants list. Poloniex and Bittrex are part of the ongoing class action lawsuit that accuses Tether and Bitfinex on allegations of fraud, deception and market-manipulation since October 2019.

US Bank Regulator Calls For Public Input On Crypto In Finance

The Office of the Comptroller of the Currency (OCC) has said it is reviewing its regulations around digital bank activities to make sure that the regulations “continue to evolve with developments in the industry.”

Information provided in PrimeXBT’s market report includes data provided by Arcane Research, in addition to other internal market research.

The information provided does not constitute, in any way, a solicitation or inducement to buy or sell cryptocurrencies, derivatives, foreign exchange products, CFDs, securities and similar products. Comments and analysis reflect the views of different external and internal analysts at any given time and are subject to change at any time. Moreover, they can not constitute a commitment or guarantee on the part of PrimeXBT. The recipient acknowledges and agrees that by their very nature any investment in a financial instrument is of a random nature and therefore any such investment constitutes a risky investment for which the recipient is solely responsible. It is specified that the past performance of a financial product does not prejudge in any way their future performance. The foreign exchange market and derivatives such as CFDs (Contracts for Difference), Non-Deliverable Bitcoin Settled Products and Short-Term Bitcoin Settled Contracts involve a high degree of risk. They require a good level of financial knowledge and experience. PrimeXBT recommends the consultation of a financial professional who would have a perfect knowledge of the financial and patrimonial situation of the recipient of this message and would be able to verify that the financial products mentioned are adapted to the said situation and the financial objectives pursued.

Risk Disclaimer:

Investing in or trading gold or other metals can be risky and lead to a complete loss of capital. This guide should not be considered investment advice, and investing in gold CFDs is done at your own risk.

The information provided does not constitute, in any way, a solicitation or inducement to buy or sell cryptocurrencies, derivatives, foreign exchange products, CFDs, securities, and similar products. Comments and analysis reflect the views of different external and internal analysts at any given time and are subject to change at any time. Moreover, they can not constitute a commitment or guarantee on the part of PrimeXBT. The recipient acknowledges and agrees that by their very nature any investment in a financial instrument is of a random nature and therefore any such investment constitutes a risky investment for which the recipient is solely responsible. It is specified that the past performance of a financial product does not prejudge in any way their future performance. The foreign exchange market and derivatives such as CFDs (Contracts for Difference), Non-Deliverable Bitcoin Settled Products and Short-Term Bitcoin Settled Contracts involve a high degree of risk. They require a good level of financial knowledge and experience. PrimeXBT recommends the consultation of a financial professional who would have a perfect knowledge of the financial and patrimonial situation of the recipient of this message and would be able to verify that the financial products mentioned are adapted to the said situation and the financial objectives pursued.