With the Easter holiday here, many traditional markets have closed for the weekend, giving traders a much-needed rest from the extreme volatility experienced throughout the first quarter of 2020.

But the cryptocurrency market never sleeps, and Bitcoin price continues to trade all weekend. Will this Easer bring about the resurrection of Bitcoin?

Also, altcoins continue to climb from recent extreme lows, fueled in part by forks Bitcoin Cash and SV reaching milestone halvings across each asset. Do these assets provide a strong example of how Bitcoin may perform with its upcoming halving scheduled for next month?

Learn this and much more in our weekly crypto market update.

Bitcoin Price Returns to Pre-Dump Levels Despite Economic Crisis

After Bitcoin’s historic, record-breaking collapse to under $4,000 on March 12, the asset has been in full recovery mode, nearly doubling in value from the bottom set last month.

The leading crypto asset by market cap had reclaimed $7,000 but failed to hold it overnight, dropping to $6,900 at the time of this writing.

Despite the recent pullback, the rally may not be over. In the past, Bitcoin price has had strong performances in the month of April.

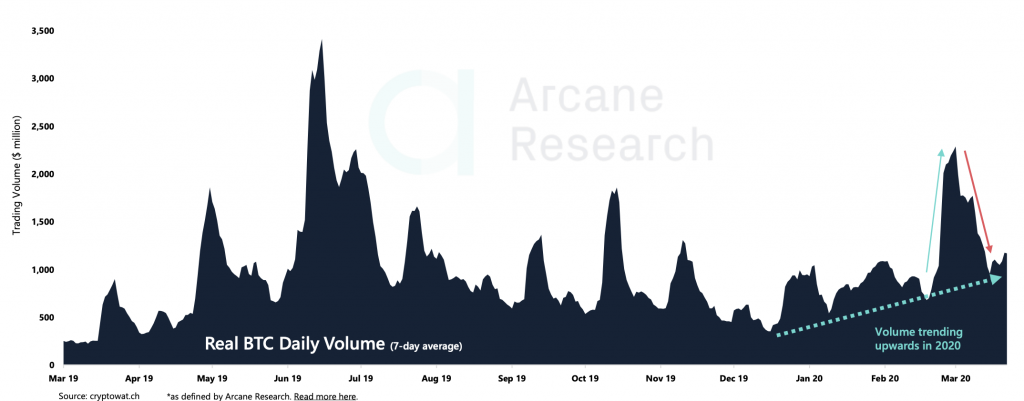

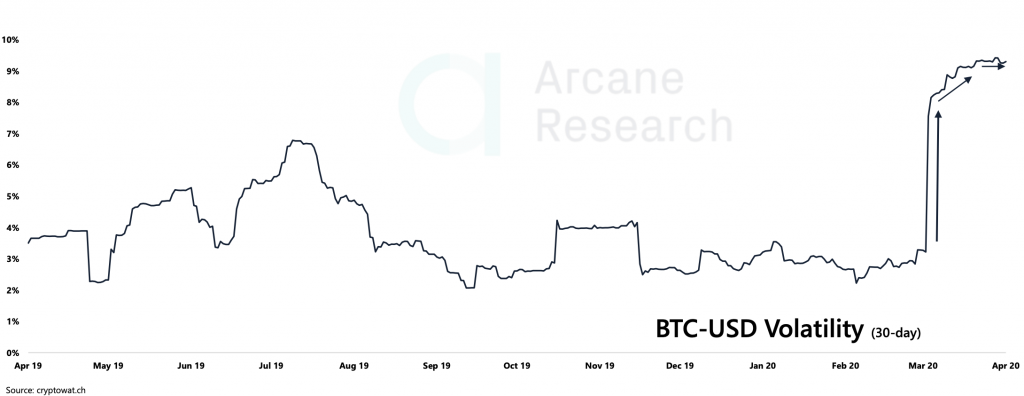

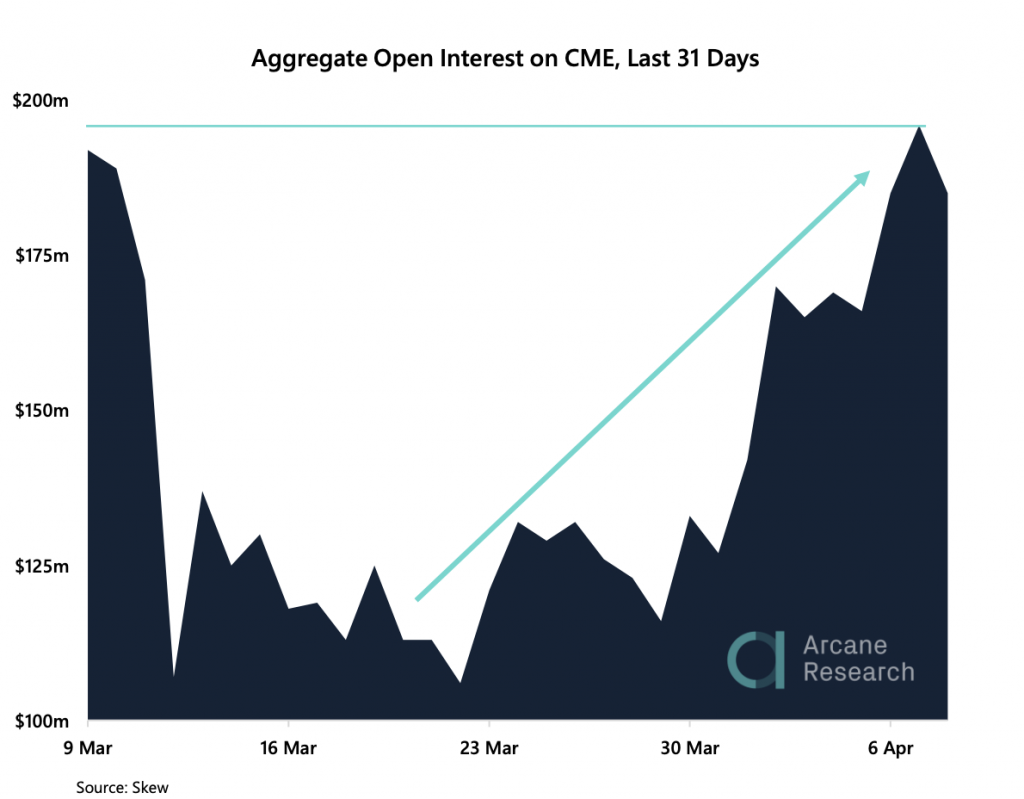

An increase in trading volume, volatility, and institutional interest suggest that valuations could continue to improve in the months ahead and Bitcoin inches closer toward its halving.

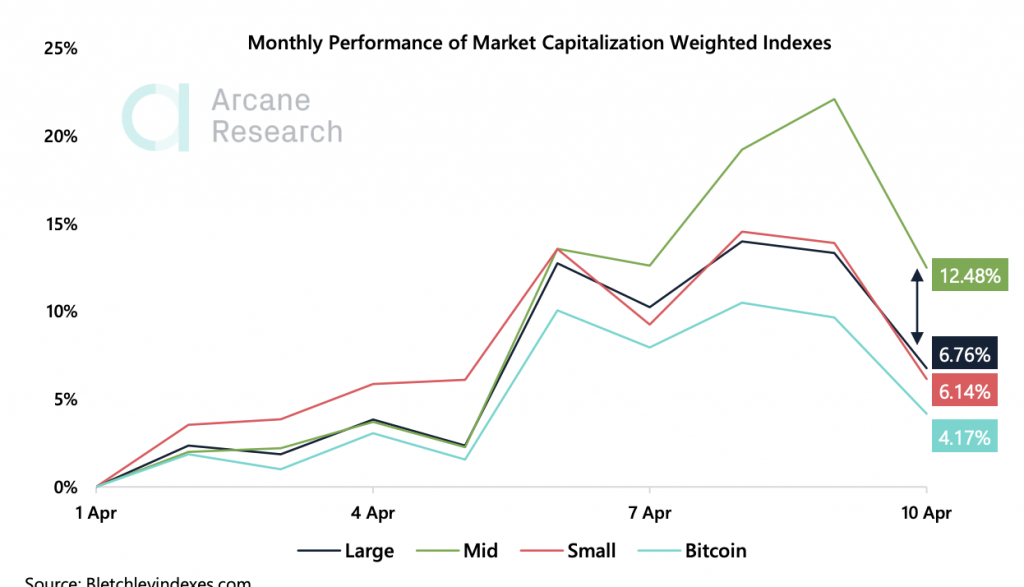

Altcoins See Positive Growth, Outperforming BTC Amid Extreme Fear

During the massive March crypto crash, altcoins suffered even worse than the first-ever cryptocurrency, falling over 70% in many cases.

But they too have been showing strong recoveries over the last month.

Ethereum had the strongest performance of the largest cap altcoins, with XRP right behind – both beating out Bitcoin by a wide margin.

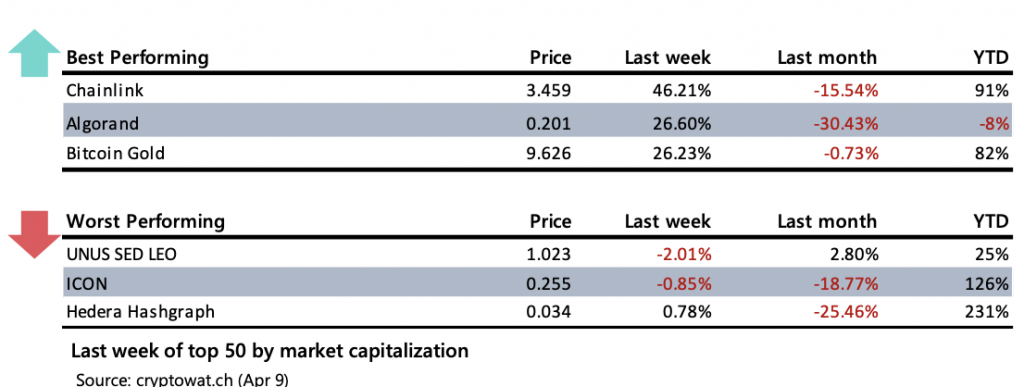

Mid-cap altcoins had the best April performance out of any group, after being the worst performers of March.

The surge in performance was mostly led by altcoin superstar Chainlink, which recently set a new all-time high last month before the crash.

Fear is still running rampant across the crypto market, according to the cryptocurrency Fear and Greed Index. While the metric began to teeter towards normal levels of fear, things have since returned to extremes.

Bitcoin Blockchain Forks Cash and SV Reach Milestone Halvings

Next month, Bitcoin will have its pre-coded halving, which reduces the block reward in BTC miners receive for validating each new block being added to Bitcoin’s blockchain.

Speculation suggests that the halving causes an offset in supply and demand, which causes prices to skyrocket, due to the already scarce supply being drastically reduced.

The idea is that miners will stop selling their BTC as the cost of production rises, causing prices to catch up to production costs as less supply is sold into the market.

Demand begins to outweigh supply heavily, and Bitcoin moons.

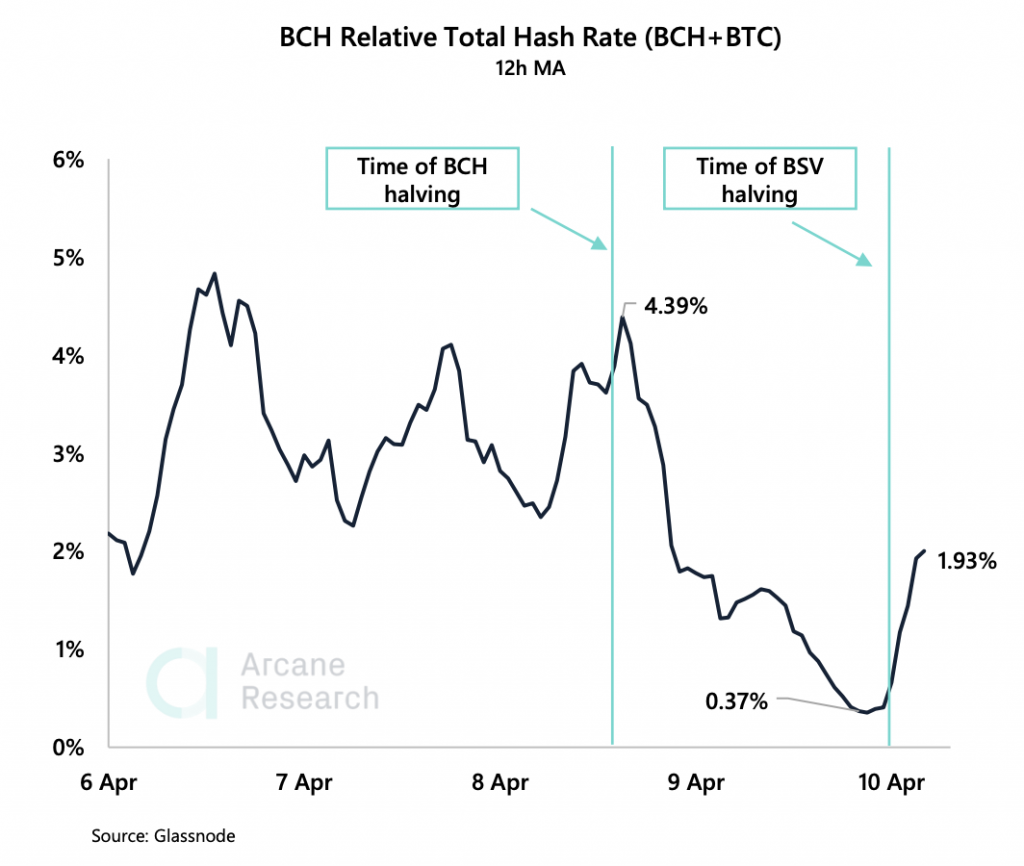

This theory was put to the test this week when forked blockchains Bitcoin Cash and Bitcoin SV had their respective halvings.

Each saw the reward of BCH and BSV miners receive reduced, causing Bitcoin mining to be twice as profitable than either spinoff for a short period of time.

The less reward immediately resulted in a dangerous drop in hash rate, but difficult quickly adjusted and the blockchain kept chugging along just fine.

In the end, Bitcoin Cash and Bitcoin SV are now valued less than they were just ahead of their halvings. Could this suggest that the halving’s effects are a myth?

Stock-to-Flow Suggests Bitcoin Is Incredibly Undervalued

Others would disagree. The highly-cited Bitcoin stock-to-flow model suggests that Bitcoin is extremely undervalued going by its limited supply.

The stock-to-flow model gives Bitcoin a valuation based on the asset’s scarcity. The stock-to-flow model would put Bitcoin currently significantly below where it should be tracking along, and the model suggests that as soon as the halving occurs, Bitcoin’s value should be closer to $75,000 per BTC based on scarcity alone.

However, the Bitcoin forks have shown, and Litecoin before it last year, that the halving doesn’t always have a direct positive effect on price. Only time will tell if the model is correct, and with Bitcoin’s halving coming in May 2020, that time is very soon.

On-Chain Data Points to Heavy Accumulation By Crypto Whales

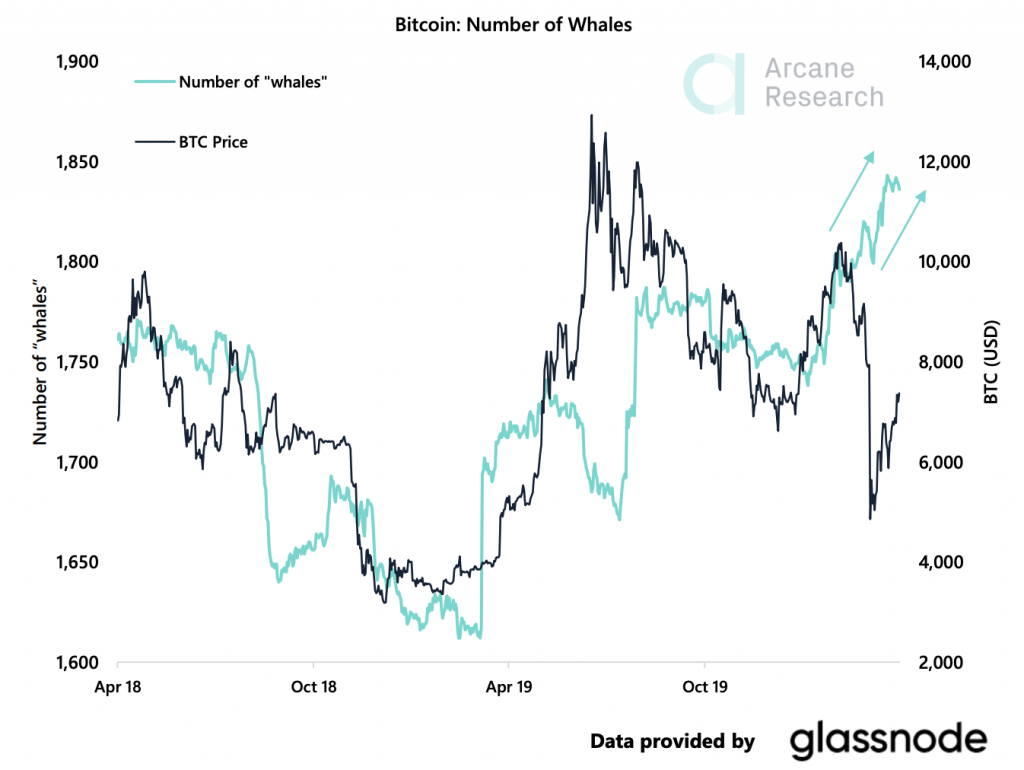

The upcoming halving this May could be in part responsible for why the largest crypto whales are accumulating Bitcoin heavily after the recent catastrophic market crash.

Investors have had over a year to buy Bitcoin from prices ranging from $3,000 to $14,000. To then again another chance to buy BTC at the lowest end of the range is a gift.

Whales are recognizing the financial opportunity and blockchain data shows that the largest Bitcoin wallets with 1000 BTC or more have been steadily increasing after the market collapse.

According to data, there haven’t been this many whales in the Bitcoin market since the 2017 top. Did those whales who sold the top then just buy the bottom with this latest collapse?

The Week’s Biggest News Stories

Demand For Online Courses Related to Bitcoin Triples

Online educational program website Udemy has seen a 300% uptick in users interested in learning about Bitcoin since the latest work from home movement first began. Could this be a resurgence in public interest in crypto once again?

$361 Million in BTC Moved For 0.50 Cent Fee

A Bitcoin transaction was spotted on the blockchain where a whale moved a massive sum of BTC for just a fraction of the cost of traditional methods.

The fee for moving over $361 million worth of BTC, was a mere 50 cents. Traditional methods such as SWIFT transfers cost upwards of $30, depending on the transaction size.

MMA Fighter Ben Askren Changes Twitter Handle To Promote Crypto

Iowa-born former MMA championship fighter Ben Askren recently changed his Twitter handle this past week, not once, but twice, to promote Bitcoin.

At first, the name was changed to call out the date of the upcoming, then later to “Time for Plan B,” in reference to Bitcoin.

The information provided does not constitute, in any way, a solicitation or inducement to buy or sell cryptocurrencies, derivatives, foreign exchange products, CFDs, securities and similar products. Comments and analysis reflect the views of different external and internal analysts at any given time and are subject to change at any time. Moreover, they can not constitute a commitment or guarantee on the part of PrimeXBT. The recipient acknowledges and agrees that by their very nature any investment in a financial instrument is of a random nature and therefore any such investment constitutes a risky investment for which the recipient is solely responsible. It is specified that the past performance of a financial product does not prejudge in any way their future performance. The foreign exchange market and derivatives such as CFDs (Contracts for Difference), Non-Deliverable Bitcoin Settled Products and Short-Term Bitcoin Settled Contracts involve a high degree of risk. They require a good level of financial knowledge and experience. PrimeXBT recommends the consultation of a financial professional who would have a perfect knowledge of the financial and patrimonial situation of the recipient of this message and would be able to verify that the financial products mentioned are adapted to the said situation and the financial objectives pursued.

Risk Disclaimer:

Investing in or trading gold or other metals can be risky and lead to a complete loss of capital. This guide should not be considered investment advice, and investing in gold CFDs is done at your own risk.

The information provided does not constitute, in any way, a solicitation or inducement to buy or sell cryptocurrencies, derivatives, foreign exchange products, CFDs, securities, and similar products. Comments and analysis reflect the views of different external and internal analysts at any given time and are subject to change at any time. Moreover, they can not constitute a commitment or guarantee on the part of PrimeXBT. The recipient acknowledges and agrees that by their very nature any investment in a financial instrument is of a random nature and therefore any such investment constitutes a risky investment for which the recipient is solely responsible. It is specified that the past performance of a financial product does not prejudge in any way their future performance. The foreign exchange market and derivatives such as CFDs (Contracts for Difference), Non-Deliverable Bitcoin Settled Products and Short-Term Bitcoin Settled Contracts involve a high degree of risk. They require a good level of financial knowledge and experience. PrimeXBT recommends the consultation of a financial professional who would have a perfect knowledge of the financial and patrimonial situation of the recipient of this message and would be able to verify that the financial products mentioned are adapted to the said situation and the financial objectives pursued.